Nick Shaxson ■ Now Brazil puts Ireland on its tax haven blacklist

We have for years remarked that one of our informal markers of a tax haven is loud tax haven denials. See our ‘we are not a tax haven‘ blog for more. There’s probably no place more vocal than Ireland, where there seems to be a veritable industry of tax haven deniers, which specialises in cherry-picking convenient facts and making a pudding of them. (The other big Irish tax myth is that it was the 12.5 percent corporate tax rate that created Ireland’s Celtic Tiger: no, it wasn’t.)

We have for years remarked that one of our informal markers of a tax haven is loud tax haven denials. See our ‘we are not a tax haven‘ blog for more. There’s probably no place more vocal than Ireland, where there seems to be a veritable industry of tax haven deniers, which specialises in cherry-picking convenient facts and making a pudding of them. (The other big Irish tax myth is that it was the 12.5 percent corporate tax rate that created Ireland’s Celtic Tiger: no, it wasn’t.)

Let’s state it clearly: Ireland is a big tax haven for multinational corporations, even if it isn’t particularly secretive. Or, in more succinct form, for those who have difficulty reading small text:

Ireland is a tax haven.

One example drawn from the copious outpourings of the Irish tax haven denial industry is this 2013 paper by two Irish officials, entitled What makes a tax haven? An Assessment of International Standards Shows Why Ireland Is Not a Tax Haven. It is an especially low-grade piece of work, cherry-picking and twisting the facts to reach a pre-determined conclusion. Not the least of its problems is that it asserts at the beginning that ‘there is no agreed definition of a tax haven,’ then proceeds to try and demonstrate that Ireland isn’t one. Sigh. Yes, the most famous Irish tax trick, the Double Irish, will eventually be phased out, but there’s lots more to the Irish box of loopholes.

An even worse piece of bamboozlement, which today’s blogger was presented with in an interview on Irish Radio Newstalk this week, is cited by Ireland’s tax haven deniers all the time. There’s this claim that somehow Ireland’s tax rate for corporations is higher than France’s.

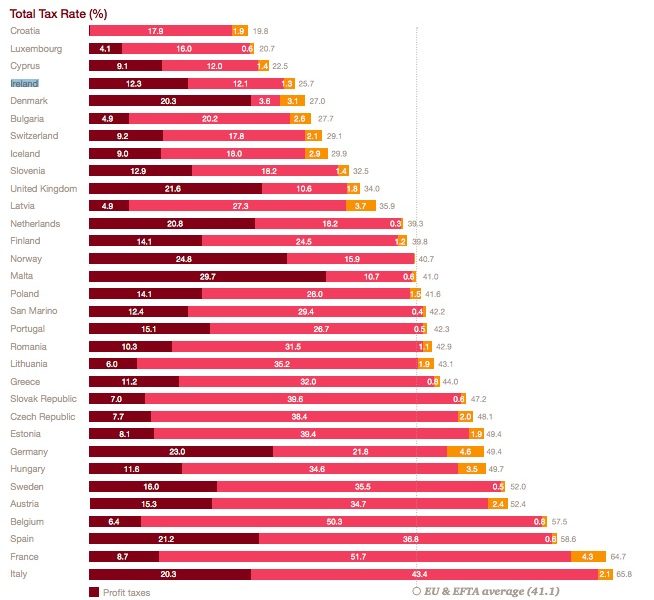

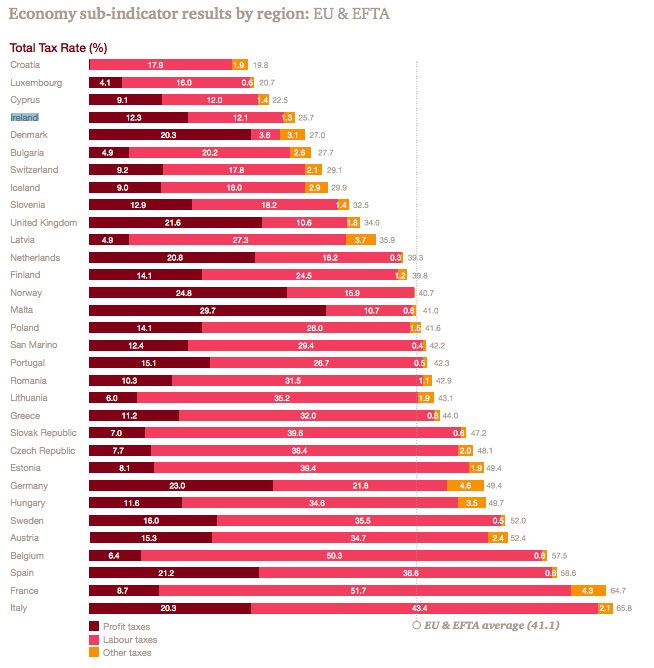

The key graph from which this factoid is drawn is this one:

And here the key take-away is from the ‘profit taxes.’ Ireland, you see, has a 12.3 percent effective profits tax rate, whereas France’s rate is 8.7 percent! Hey presto! Ireland isn’t a tax haven. We can’t emphasise enough how often we’ve seen this cited in evidence, or had this one flung at us from the deniers.

There’s just one teeny problem with this. This is just a model company, and it’s based on certain assumptions. Such as:

“Is 100% domestically owned and has five owners, all of whom are natural persons.”

That rules out Apple, Google, and all those others. But there are plenty more. Here’s another:

“Specifically, it produces ceramic flowerpots and sells them at retail. It does not participate in foreign trade (no import or export) and does not handle products subject to a special tax regime.”

(with thanks to Jim Stewart at Trinity College, Dublin, for first pointing this delicious piece of nonsense out to us: There are loads more of these assumptions: see p140 here.)

We could go on about the fact that Ireland is a tax haven.

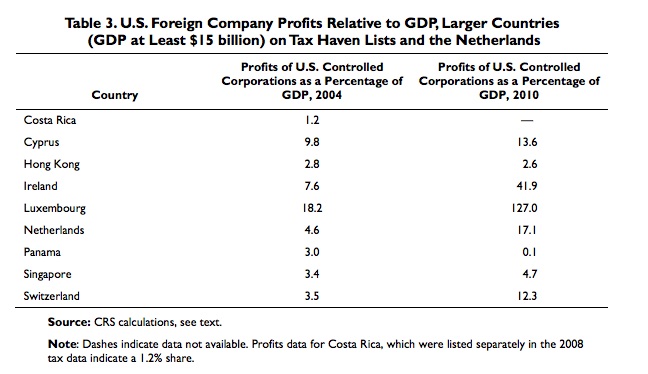

The U.S. Senate hearings. The EU’s recent moves against Apple‘s Irish shenanigans. Articles such as this. Our long history of how Ireland became a tax haven. Studies such as this one, containing tables like this:

(By comparison, the shares for France, Germany and the UK are 0.3, 0.2 and 1.3 percent of GDP.)

Or we might cite Alex Cobham’s and Petr Jansky’s 2015 study for the International Centre for Tax and Development, which looks at the misalignment between where profits are reported, and where economic activity takes place. It concludes:

“The majority of missing profit from jurisdictions where real activity takes place ends up in just a few jurisdictions with near-zero effective tax rates – the Netherlands, Ireland, Bermuda and Luxembourg are the most important by far, and with Singapore and Switzerland account for almost the entirety of profit shifting that can be allocated to individual jurisdictions.”

And so on. Where there’s smoke, there’s fire. ‘We are not a tax haven’, indeed.

Anyway, we’ve said much of this before.

The point of this blog is really to provide a snippet of news. Brazil has just added Ireland to its list of tax havens. Ireland was added a couple of days ago.

Repeat after us:

Ireland is a tax haven.

Ireland is a tax haven.

Ireland is a tax haven.

With thanks to Juan Valerdi for the Brazil tip.

Related articles

The secrecy enablers strike back: weaponising privacy against transparency

Privacy-Washing & Beneficial Ownership Transparency

26 March 2024

Inequality Inc.: How the war on tax fuels inequality and what we can do about it

New Tax Justice Network podcast website launched!

El secreto fiscal…tiene cara de mujer: January 2024 Spanish language tax justice podcast, Justicia ImPositiva

Tax Justice Network Arabic podcast #73: ملخص 2023

Get rich cheating in our (educational) tax dodgers version of monopoly

New report on how to fix beneficial ownership frameworks, so they actually work

The Tax Justice Network’s most read pieces in 2023

Without the Tax Haven industry Ireland would have nothing, I mean nothing, there is no homegrown employment, though the Irish hide this as they put every one on work programs and pretend its genuine jobs, but the Irish themselves are getting tired of this nonsense as the work program ‘ jobs ‘ are not considered real employment by banks, credit companies etc. The steering wheel has definitely come off the clown car otherwise known as Ireland