Nick Shaxson ■ UK moves forward on Country by Country reporting

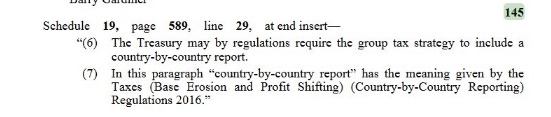

They said it would never happen – but here it comes. From the UK lower house of parliament, an amendment to legislation which looks like this:

This is very welcome news, even though the amendment is far from perfect.

It’s rare indeed for an opposition amendment to a Finance Bill to be successful, and this reflects great work by Caroline Flint, a Member of Parliament (MP) and colleagues, along with major NGOs including Christian Aid, ActionAid, Oxfam and Save the Children, in obtaining cross-party support, leading to the government’s decision to support it also. Special thanks, of course, to Richard Murphy, who pioneered the concept.

Country-by-country reporting, a project pushed by TJN since its inception in 2003, is about requiring multinational corporations to disclose financial details about their operations in every country where they are active. This is obviously a basic prerequisite of democratic society, yet it has been largely absent from the world until recently. As our Country by Country Reporting page attests, institutions (such as the EU and OECD) and individual countries, including the UK, are now starting to put this concept into practice.

There is a big catch, however: and that is whether this information should only be available to (selected) tax authorities, or to the general public. Lobbying by multinationals has so far generally ensured that Country by Country reporting (CbCR) will remain hidden from journalists, anti-corruption campaigners, market participants, and so on. As the recent Apple affair, the Luxleaks scandal, and many other cases attest, governments can’t be trusted on their own to put in the required effort to tax multinationals properly – so it’s essential that this information is made public, so that societies can ensure that it’s not just the multinationals who are called to account, but governments too.

So this amendment is a significant step forwards, enshrining the view that this information should be public. But note the catches most obviously, “The Treasury may . . . “. It doesn’t commit the UK to publication. This is realpolitik in action: when Caroline Flint MP first proposed an amendment, the UK government, which has a long track record of being in thrall to multinational lobbying, said it wouldn’t accept it, so this softer version was agreed. Flint was quoted in The Guardian:

“We have changed the amendment so that it no longer binds the government to a strict timetable, but would commit ministers to the principle of transparency . . . “The only reason they might reject this is if they really do not want it to happen.”

A cynic might think that the government preferred to accept an amendment giving it the power, but not the obligation, to make CBCR public, rather than risk defeat on an amendment including the obligation. But the government’s public support for this, following that of the previous Chancellor George Osborne, suggests there is a growing and genuine commitment. Opposition MPs should now be looking to elicit a statement of the form, “Her Majesty’s Government will work to obtain a multilateral agreement (e.g. EU or G20) to publish this data for all multinationals; but will act unilaterally if that agreement is not achieved by (e.g. 2018).”

In addition, there remains a lack of clarity on how far the amendment could be made to bind on multinationals that are not UK-headquartered. This measure is therefore short of what is ultimately required – but it is nevertheless an important advance towards the eventual publication of harmonised country-by-country reporting for all significant multinationals globally.

Related articles

New Tax Justice Network podcast website launched!

Overturning a 100 year legacy: the UN tax vote on the Tax Justice Network podcast, the Taxcast

The People vs Microsoft: the Tax Justice Network podcast, the Taxcast

New Tax Justice Network Data Portal gives unparalleled access to wealth of data on tax havens

Convenção na ONU pode conter $480 bi de abusos fiscais #52: the Tax Justice Network Portuguese podcast

Taxes, a matter of life or death

Shareholders to vote on tax transparency as report raises serious questions for Canada’s largest alternative asset manager

Tax saves lives: the Tax Justice Network podcast, the Taxcast

Tax Justice Network letter to King Charles III – Full Text