Nick Shaxson ■ Tax cuts and prosperity: new US evidence

Updated with an additional story

From the New York Times:

“How can America’s leaders foster broad prosperity? For most Republicans — including Donald J. Trump — the main answer is to “cut and extract”: Cut taxes and business regulations, including pesky restrictions on the extraction of natural resources, and the economy will boom. Mr. Trump and House Speaker Paul Ryan are united by the conviction that cutting taxes — especially on corporations and the wealthy — is what drives growth.”

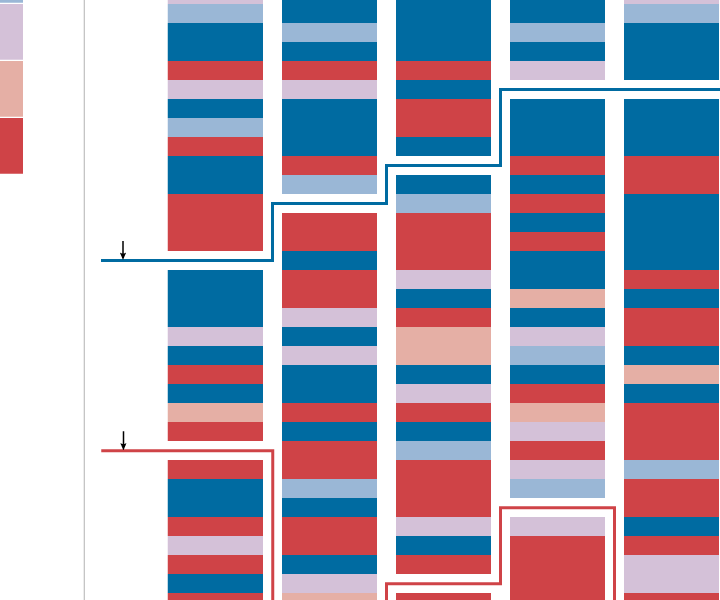

The NYT provides a handy graphic, using political party affiliation as a proxy for tax-and-spend policies. The red states tend to favour “cut and extract”, while the blue states tend to favour more tax and public investment.

Which states have fared better on quality of life indicators? Click on the article to see the graphic.

There’s a question of causation here (do people vote for certain parties because they’re deprived – or are they deprived because of the policies these parties enact?). But it’s still a powerful set of observations, complementing a whole lot of other research elsewhere.

Also see Ed Kleinbard’s excellent “tour de force” We are Better Than This: How Government Should Spend Our Money, about tax and spending in the U.S.

Update: There’s another new New York Times story, The Case for More Government, that’s also relevant here.

“Last month, four academics — Jeff Madrick from the Century Foundation, Jon Bakija of Williams College, Lane Kenworthy of the University of California, San Diego, and Peter Lindert of the University of California, Davis — published a manual of sorts. It is titled “How Big Should Our Government Be?” (University of California Press).

. . .

Here are some other things Europeans got from their trade-off: lower poverty rates, lower income inequality, longer life spans, lower infant mortality rates, lower teenage pregnancy rates and lower rates of preventable death. And the coolest part, according to Mr. Lindert — one of the authors of the case for big government — is that they achieved this “without any clear loss in G.D.P.”

Now read on.

Related articles

Ireland (again) in crosshairs of UN rights body

New Tax Justice Network podcast website launched!

People power: the Tax Justice Network January 2024 podcast, the Taxcast

As a former schoolteacher, our students need us to fight for tax justice

Submission to the UN Special Rapporteur on extreme poverty and human rights’ call for input: “Eradicating poverty in a post-growth context: preparing for the next Development Goals”

17 January 2024

Submission to the Committee on Economic, Social Cultural Rights on the Fourth periodic report of the Republic of Ireland

The Corruption Diaries: our new weekly podcast

Tax Justice Network Arabic podcast #73: ملخص 2023

ESCOLA DE HERÓIS TRIBUTÁRIOS #56: the Tax Justice Network Portuguese podcast

Tax cuts mean that less government workers can be employed although those who are less taxed have more to spend. By looking on both sides of the situation it becomes clear that tax cuts are politically accepted because those who pay them are those who support the politicians involved. This is not a fair and balance situation and it is gradually resulting in the bias toward taxation hurting the lower-paid parts of the middle class, in comparison to the rest. If the taxation system were made to bear most heavily on those who are exploiting the national economy the most, a greater degree of social justice would result, but this kind of a change is maliciously labeled “politically unacceptable” whilst it should be called “beneficial to far more than it penalizes”. Somebody needs to pay, so why should it not be set at a number of monopolists and speculators, whose insistence on land withholding is spoiling the opportunities of the rest of us. Tax land not people, tax takings not makings!

Is it not interesting that the longest sustained period of almost constant and uninterrupted time of economic growth among all races and economic classes was 1946-1971, which was also the quarter century during which we had the highest marginal tax rates for the wealthy and higher government expenditures as a portion of GDP than any other quarter century in our history. What did we accomplish in those years when accepted Republican economic dogma of lower taxes and small government tells us we should have collapsed into abysmally low employment, unmanageable and hopeless national debt, and the ruination of our capitalist economy? Well here is what actually happened: Our government spent more dollars on bigger projects as a portion of GDP than at any other time in our history. We rebuilt war torn Europe and Japan. We funded the GI bill which permitted more Americans to purchase homes and more Americans to attend college than ever before in our history, actually than ever before in the history of any nation. (Which of course led to the construction of the greatest university system the world has ever seen.) We built an industrial behemoth that was the rival of the world. We built the Interstate Highway System, new airports, expanded ports and navigable waterways, built water and sewage treatment plants in cities and towns across the land and we did all of this while retiring the debt from WW II and theGreat Depression and simultaneously built the greatest military on the planet. Additionally while doing all of this, just for fun, we sent men into outer space and eventually to the moon. What have we done since we began to lower taxes and cut government spending in 1980? Where are the comparable accomplishments? They are non-existent. but we have raised the national debt from $800 Billion to $17 trillion.We have witnessed all of that fantastic infrastructure we built in that golden age began a steady crumble and decay. We have seen most of our national fortune go to the one percent and the uninterrupted decline of the world’s greatest middle class. We have seen college costs skyrocket back to where either, once again, only the wealthy go to college or those willing to saddle themselves with a six figure debt to begin their working lives. That is the evidence for the idea that lower taxes create prosperity and higher taxes only lead to debt and decline, seems to me the evidence indicates the conservative dogma just might be wrong.