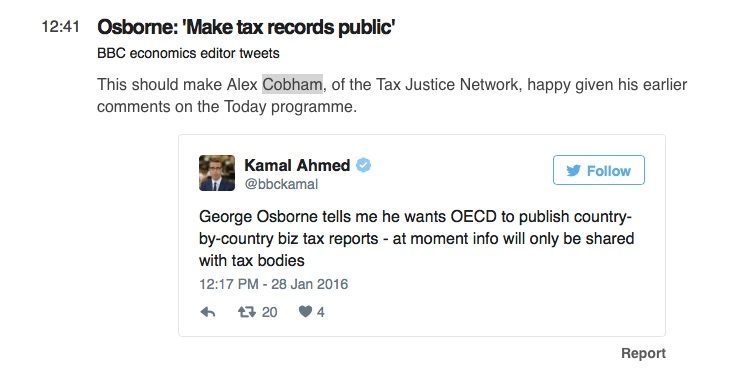

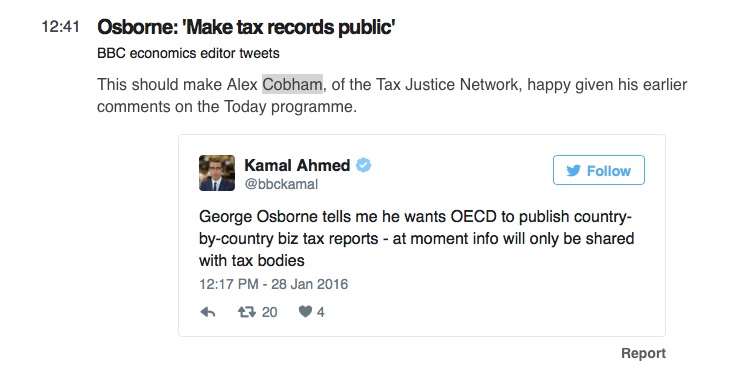

Nick Shaxson ■ TJN calls for public country by country reporting. A few hours later . . .

This morning Alex Cobham, TJN’s Director of Research, called for public country-by-country reporting, in an interview with the BBC’s flagship Today programme (19:20ish).

“Country-by-country reporting: that was actually a Tax Justice Network proposal, going back to our establishment in 2003; but the key to it is for that information to be public: if tax authorities have it, that helps them. But we need to be able to hold tax authorities to account: to know, for example, if HMRC [the UK tax authority] is treating Google fairly.”

What do you know? A few hours later, also on the BBC:

We’ve got lots more to say on this, of course, but for now we’ll just ask this: can the timing be a coincidence?

We’ve got lots more to say on this, of course, but for now we’ll just ask this: can the timing be a coincidence?

More on country by country reporting here.

Endnote: we’ve blogged Google twice in the last couple of days: see Prof. Sol Picciotto’s more wonkish blog, and our more sweeping earlier one, looking at the economic illiteracy of the Mayor of London.)

And as an update, we’re launching an official complaint at the EU about all this.

Related articles

New Tax Justice Network podcast website launched!

Overturning a 100 year legacy: the UN tax vote on the Tax Justice Network podcast, the Taxcast

The People vs Microsoft: the Tax Justice Network podcast, the Taxcast

New Tax Justice Network Data Portal gives unparalleled access to wealth of data on tax havens

Convenção na ONU pode conter $480 bi de abusos fiscais #52: the Tax Justice Network Portuguese podcast

Taxes, a matter of life or death

Shareholders to vote on tax transparency as report raises serious questions for Canada’s largest alternative asset manager

Tax saves lives: the Tax Justice Network podcast, the Taxcast

Tax Justice Network letter to King Charles III – Full Text