Nick Shaxson ■ Google’s taxes and the economic illiteracy of the Mayor of London

[vc_row][vc_column][vc_column_text]

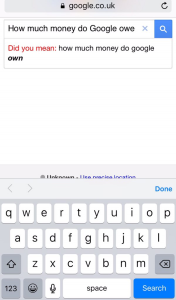

Courtesy of Uncounted. (Answer: $100 billion)

No, not the Lord Mayor of London, but the Mayor of London, a certain Boris Johnson, who’s frequently tipped to be Britain’s next Prime Minister. Given that Britain is arguably the most important player in the global offshore system, this man’s opinions deserve close scrutiny.

The topic at hand is Google’s tax affairs in the UK, and the UK government’s triumphant widely derided announcement that Google would be paying an extra £130 million in back taxes over the last 10 years.

At £13 millionish per year, anyone could tell you that that isn’t enough. And some calculations have been made, as Uncounted summarises:

“Prem Sikka quickly calculated Google’s effective tax rate (given some necessary assumptions on relative profitability of UK operations) at around 2.77%. Richard Murphy suggested tax of around £200 million each year would be about right, as did Jolyon Maugham QC (and like Prem, put Google’s new effective rate near 3%).”

All these calculations are useful tools and techniques for looking at the problem, which can be replicated in other cases.

Now, London’s Mayor, the clownish but very influential Boris Johnson. He’s written an extraordinary article in the Telegraph newspaper, which starts well:

“It has never seemed fair that some of these companies – no matter how wonderful the service they provide – should be paying so much less in tax than the high-street tea rooms and bookshops they have pulverised. It would be a good thing, both for the UK finances and for the image of these great companies, if they paid more.”

Quite so. He’s put his fingers on one of the ways modern capitalism is being corrupted by offshore tax shenanigans: helping bigger players to out-compete and ‘pulverise’ the smaller players on a factor – tax – that has nothing to do with genuine productivity and everything to do with raw wealth extraction.

But then his understanding of how the world works goes, as he might put it, ‘squiffy.’

“It is absurd to blame the company for “not paying their taxes”. You might as well blame a shark for eating seals. It is the nature of the beast; and not only is it the nature of the beast – it is the law. It is the fiduciary duty of their finance directors to minimise tax exposure.”

Where to start?

First, companies can display varying degrees of aggression in their tax policies, which don’t involve their having to snake their financial affairs out to Ireland and Bermuda, as Google has done. Paying an effective 2.8 percent tax is highly aggressive action taken against the taxpayers of the United Kingdom (in this case, and against those of many other countries.)

Second, this fiduciary thing. They are required to do this? Wrong, Boris, and we obtained a formal legal opinion to this effect. (The full legal opinion is here.)

Now for some http://premier-pharmacy.com/product-category/alcoholism/ more, perhaps even more foolish, comment.

“The Irish decided they wanted to go for an ultra-low corporation tax, at 12.5 per cent. It was their sovereign ambition to attract the HQ of Apple and others. They wanted Irish taxi drivers to have the honour of ferrying Apple executives around, and they wanted Irish waitresses to snaffle their huge tips. The EU Commission is partly excited by the chance to bash a corporate American giant; but mainly it is a chance to attack tax arbitrage between member states – to move ever closer towards uniformity and away from a spirit of healthy competition between jurisdictions. We need that competition.“

Again, where to start with this nonsense?

First, it’s not Ireland’s 12.5 percent tax rate that it is the big one: it is Ireland’s vast appetite for creating and tolerating loopholes that mean only a tiny percentage of a corporation’s income ever gets subjected to that 12.5 percent tax.

Second, let’s knock this “every tax haven has a sovereign right to set its own tax rate” on the head. It may be true that some tax havens have a sovereign right to set their own tax rates (although, it must be said, the British tax havens actually don’t have this right.) But if that is the case, then it is the sovereign right of other nation states (in this case Britain) whose own tax systems are undermined and attacked by a tax haven (in this case Ireland, or Bermuda) to take measures — including aggressive measures — to defend themselves from attack. And they have every sovereign right to join together in supra-national arrangements (such as joining groups like the EU) to help put weight behind their defensive measures.

Third, don’t get us started on ‘healthy competition between jurisdictions.’ This is the most economically illiterate part of the whole article.

For one thing, all – and we mean all – ‘competition’ between jurisdictions on tax is harmful: every time, always. (Fools’ Gold has outlined a spectacular range of harms that stem from ‘competition’ between nations on things like tax: that site is a work in progress: there are other harms.)

To quote Paul Krugman on the economic illiteracy of eulogising this kind of competition:

“If we can teach undergrads to wince when they hear someone talk about ‘competitiveness,’ we will have done our nation a great service.”

Or Martin Wolf:

“The notion of the competitiveness of countries, on the model of the competitiveness of companies, is nonsense.”

To get a first inkling of why competition between companies in a market is nothing like ‘competition’ between countries, ponder the difference between a failed company and a failed state.

For a full overview of the extraordinary world of the Competitiveness Agenda – and this is a prime example of it – please do peruse see the Fools’ Gold site.

Also do take a look at our comprehensive defence of the corporate income tax, here.

[/vc_column_text][vc_raw_js]

JTNDYmxvY2txdW90ZSUyMGNsYXNzJTNEJTIydHdpdHRlci10d2VldCUyMiUyMGxhbmclM0QlMjJlbiUyMiUzRSUzQ3AlMjBsYW5nJTNEJTIyZW4lMjIlMjBkaXIlM0QlMjJsdHIlMjIlM0VIYSUyMSUyMCUzQ2ElMjBocmVmJTNEJTIyaHR0cHMlM0ElMkYlMkZ0d2l0dGVyLmNvbSUyRmhhc2h0YWclMkZHb29nbGVUYXglM0ZzcmMlM0RoYXNoJTIyJTNFJTIzR29vZ2xlVGF4JTNDJTJGYSUzRSUyMHZpYSUyME1FUCUyME1vbGx5JTIwU2NvdHQlMjBDYXRvJTI2JTIzMzklM0JzJTIwRmFjZWJvb2slMjBwYWdlJTIwJTNDYSUyMGhyZWYlM0QlMjJodHRwcyUzQSUyRiUyRnQuY28lMkZscWt4aUxUbDJuJTIyJTNFcGljLnR3aXR0ZXIuY29tJTJGbHFreGlMVGwybiUzQyUyRmElM0UlM0MlMkZwJTNFJTI2bWRhc2glM0IlMjBOYW9taSUyMEZvd2xlciUyMCUyOCU0ME5hb21pX0Zvd2xlciUyOSUyMCUzQ2ElMjBocmVmJTNEJTIyaHR0cHMlM0ElMkYlMkZ0d2l0dGVyLmNvbSUyRk5hb21pX0Zvd2xlciUyRnN0YXR1cyUyRjY5MTMxNzYwNTEwMjEyNTA1NyUyMiUzRUphbnVhcnklMjAyNCUyQyUyMDIwMTYlM0MlMkZhJTNFJTNDJTJGYmxvY2txdW90ZSUzRSUyMCUzQ3NjcmlwdCUyMGFzeW5jJTIwc3JjJTNEJTIyJTJGJTJGcGxhdGZvcm0udHdpdHRlci5jb20lMkZ3aWRnZXRzLmpzJTIyJTIwY2hhcnNldCUzRCUyMnV0Zi04JTIyJTNFJTNDJTJGc2NyaXB0JTNF

[/vc_raw_js][/vc_column][/vc_row]

Related articles

Inequality Inc.: How the war on tax fuels inequality and what we can do about it

New Tax Justice Network podcast website launched!

The People vs Microsoft: the Tax Justice Network podcast, the Taxcast

Can the UN succeed? Top questions about our State of Tax Justice report

Switzerland’s tax referendum is a choice between tax havenry and more tax havenry

Tax Justice Network Arabic podcast #66: الضريبة الموحدة على الشركات والفرص الضائعة

Monopolies and market power: the Tax Justice Network podcast, the Taxcast

Tax Justice Network Arabic podcast #62: بولط تونس: تسريب معطيات نحو تل أبيب، تهرّب ضريبي وجرائم أخرى

The Making of Tax Haven Mauritius: the Tax Justice Network podcast, the Taxcast