Nick Shaxson ■ Crickhowell and the tax rebellion: the mouse that roared?

Update: the Crickhowell activists have set up a new website: Fair Tax Town.

We’re delighted to see that a forthcoming BBC TV programme will highlight a major tax injustice that we have long drawn attention to: that multinational corporations are killing small businesses partly by being able to out-dodge them on tax. Britain’s Independent newspaper reports:

“When independent traders in a small Welsh town discovered the loopholes used by multinational giants to avoid paying UK tax, they didn’t just get mad.

Now local businesses in Crickhowell are turning the tables on the likes of Google and Starbucks by employing the same accountancy practices used by the world’s biggest companies, to move their entire town “offshore”.

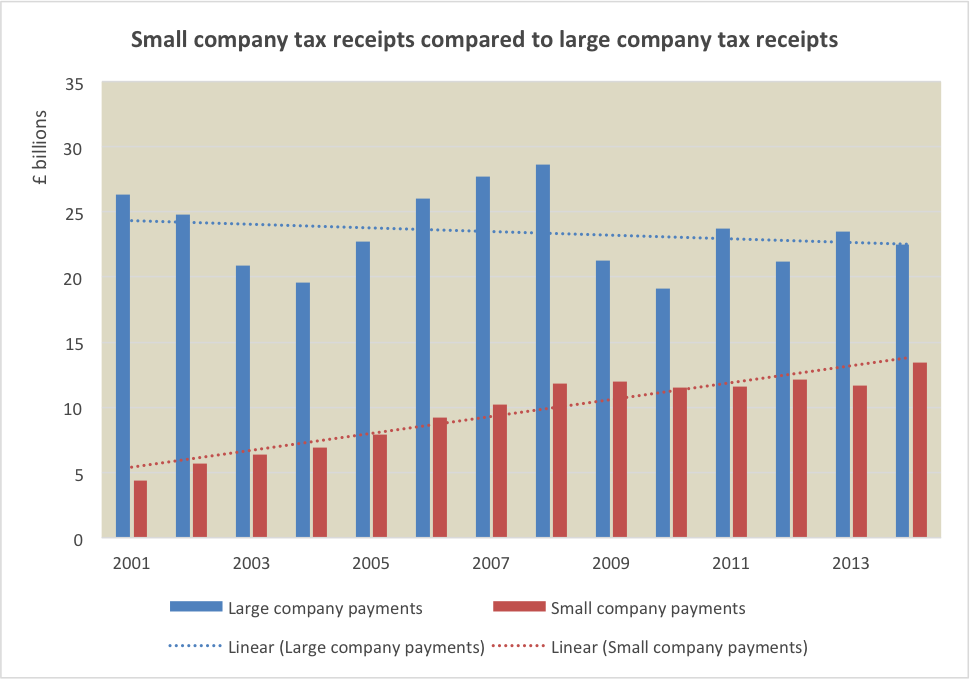

This graph from Fools’ Gold highlights a big picture behind their anger:

And a widely referenced report on corporate taxes that we published this week shows that all this tax-cutting and loophole-creating for large corporations has been accompanied by an increase in corporate profit-shifting. This points to something that we’ve said for a long time: these giveaways are generally worse than pointless: large revenue losses with no benefits except for a lucky few. (More on this very soon.)

So we welcome the exposure of this stuff, but it does pose a question: should we support the actions themselves?

We do have reservations about tax resistance as a protest tool. Some within the tax justice movement ask whether it is a legitimate protest tool at all. We generally argue that tax is the lifeblood of democracy and encouraging people not to pay tax is a perverse way of approaching the question. However, tax resistance has a long and honourable tradition – think back to the tax protests of the Suffragettes, of Mahatma Gandhi; or of the Poll Tax movement.

We are prepared to look at each specific case and discuss to what extent the particular actions can be justified, in light of the specific aspects of tax justice — or justice — being sought.

The particular context here is that this programme will be fronted by Heydon Prowse, a well known British comedian. We believe – though we aren’t in possession of the full facts as the film is still being edited – that it is an absurdist caper to expose to a television audience the inner workings and injustices of corporate tax avoidance. It seems the participants don’t expect their scheme to work: the aim is to raise awareness and to make people angry. And there doesn’t seem to be anything illegal involved either:

“the traders had a “very good meeting” with HMRC when they submitted their offshore tax plan for approval.”

So with this perspective (and if their tax plan is rejected but it gets a lot of people to think hard about what’s going on) then there may well be a good case for welcoming and celebrating this. And we should remind people that we’re a broad, flexible network with many different members with many different opinions: see how we operate.

One thing you can be sure of: all of us will watch this programme with great interest. We know the film makers, and some of them have been involved in some of the most compelling and outrage-inducing programming that is out there.

Here’s one. And here’s another. Enjoy.

Finally: as an update, the folk of Crickhowell have now produced this video.

Related articles

🔴Live: UN tax negotiations – First Session

What to know and expect ahead of this week’s UN tax negotiations

The secrecy enablers strike back: weaponising privacy against transparency

Privacy-Washing & Beneficial Ownership Transparency

26 March 2024

Ireland (again) in crosshairs of UN rights body

Tax policy and gender disparity: A call to action on International Women’s Day 2024

Policy research conference: How a UN Tax Convention can address inequality in Europe and beyond

The IMF’s anti-money laundering strategy review is promising, but it all comes down to implementation

Inequality Inc.: How the war on tax fuels inequality and what we can do about it

Proposal for ‘Business in Europe: Framework for Income Taxation’ (BEFIT): A wrong turn in the right direction

2 February 2024

Great Idea one law for all go Wales !

WELL DONE EVERYONE INVOLVED..it really is time that the tax system was administered fairly it is just SO UNFAIR that big companies pay very little – come on HMRC apply the same rules to all of us or tax havens here we come town by town throughout ALL of Britain

Shame on those companies that don’t pay their full tax obligation such as Neros. I’ll not drink their coffee again (I already boycott Starbucks, and others). Shame also on HMRC for letting them get away with it. However is there a better way for all of us who see this as outrageous to make our protest felt?

The Scottish Land Revenue Group (www.slrg.scot) proposes the adoption of what it calls Annual Ground Rent (AGR) in place of taxes on incomes, employment, enterprise and consumption. For AGR read LVT. Such a reform, replacing current taxes with a levy on the rental value of land, would of course CANCEL all tax avoidance outright. So there is the solution if society should choose to sort this. The devastating 1:1 deadweight losses would also be history, providing in Scotland’s case an extra net £11+ billion a year. We are not that poor really as a country. We just happen to currently give most publicly created value to the owners of land instead of using it to fund our unnecessarily impoverished public services.

TJN has always strongly supported a Land Value Tax, as part of a broad-based tax system. But we also believe that those LVT groups that want to replace all other taxes with LVT are doing the LVT cause a serious dis-service by being so absolutist. In the words of Samuel Brittan:

“A land tax is one of those subjects – basic income is another – which divides commentators into a great majority who never mention it, and a minority who talk of nothing else. The result is to give supporters a cranky appearance, while the eyes of chancellors of either main party glaze over if you as much as mention the subject.”

It’s easy to avoid tax if you only have an LVT and nothing else – just shove your mobile capital assets (like bank accounts) offshore. And believe us, the ‘deadweight losses’ of not having a corporate tax, say, are far greater: see here. https://www.taxjustice.net/2015/03/18/new-report-ten-reasons-to-defend-the-corporate-income-tax/

As the large corporations pay less and sometimes no tax the government is taxing the small businesses even more. I suppose that while we have political leaders who are benefiting from this we are never going to get a fair tax regime. Just look at Mr Osbourne’s family business and all will be revealed, they are nothing more than common thieves, stealing from the poor to give to the rich, go Crickhowell. How do I join?

From what I understand of Cameron and Osborne, they only put on a thin pretence to be interested in smaller and/or poorer people and businesses.

I stumbled upon your site after I had googled, “DIY” Tax avoidance.

We have a lovely Welsh hill farm near Aberystwyth. By coincidence, my route goes through Crickhowell.

I am hoping to set up a trust, the assets of which would be mainly land and buildings.

A Welsh hill farming family have the grazing rights.

To start with, I would own 100% of the assets, but I want slowly to transfer the assets to our Welsh farming friends and a Welsh veterans’ association so that my own holding would slowly reduces to very little.

I applaud Prince Harry for his Invicta Games, but not everyone wants to play games. This beautiful little farm has many assets that could be used by creative people using wood, stone etc. as well as artists or people who want be quiet, or study nature etc., etc.

There could be crippling income, capital and inheritance taxes. I want to reduce these to a minimum. I am not wealthy, but am generous. I wish to give a very great deal to this vision, not in money, but in kind. If any of you, reading this, are interested in some way, it would be great to hear from you.

I meant to add that, like several in Crickhowell people have said, “I want to pay fair taxes”. But if going “off-shore” , for smaller people, is a powerful way to force the government to make corporations pay their fair share, then I’m all for it.