Nick Shaxson ■ Still Broken: major new report on global corporate tax cheating

Update, Dec 7, 2015: a new paper in the Journal of World Business, which contains this:

“Home country statutory corporate tax rates have a small impact on tax haven use. In general, corporate tax rates are an important factor in driving MNEs to set up tax haven subsidiaries. However, as long as there is a significant gap between tax rates in OECD countries and those in tax havens, our results suggests that reducing corporate tax rates will not substantially change the likelihood of MNEs setting up tax havens subsidiaries. MNEs will continue to take advantage of the host country specific advantages available in tax haven locations, which include minimal rates of corporate income tax, light-touch regulation and secrecy.”

Our emphasis added. Which strongly supports the conclusions of the reports we cite below.

From the summary of our co-authored new report:

“In 2013 the OECD, supported by the G20, promised to bring an end to international corporate tax avoidance which costs countries around the world billions in tax revenues each year. However, with the recently announced actions against corporate tax dodging, G20 and OECD countries have failed to live up to their promise. Despite some meaningful actions, they have left the fundamentals of a broken tax system intact and failed to curb tax competition and harmful tax practices.”

In dollar terms, G20 countries are the biggest losers – while low income developing countries such as Honduras, the Philippines and Ecuador are hardest hit because corporate tax revenues comprise a higher proportion of their national income. The G20 Heads of State are expected to consider a package of measures they claim will address corporate tax avoidance at their annual meeting in Turkey on 15th and 16th November.

The key reforms are the OECD’s so-called “BEPS” project on corporate tax cheating, which we’ve written about extensively. And the details from the report:

“In 2012, US multinationals alone shifted $500–700bn, or roughly 25 percent of their annual profits, mostly to countries where these profits are not taxed, or taxed at very low rates. In other words, $1 out of every $4 of profits generated by these multinationals is not aligned with real economic activity.”

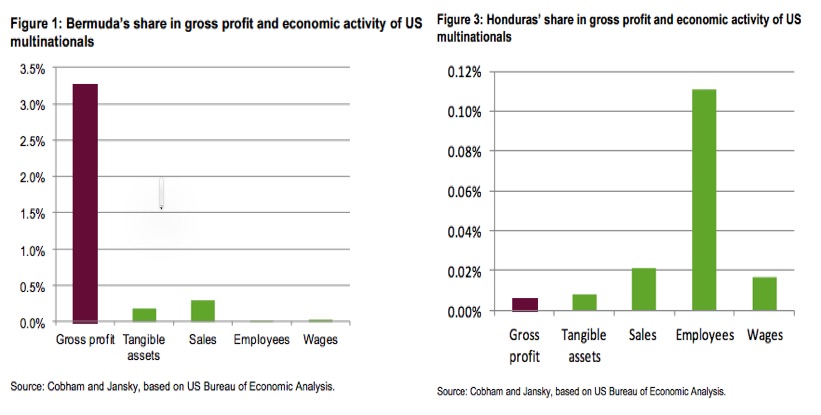

These findings are based on major new TJN research by Alex Cobham and Petr Jansky, which can be found here (and will be permanently available on our “Reports” and “Magnitudes” pages: it focuses on U.S. multinationals, not just because it’s important, but also because of data availability.)

Here’s a picture that illustrates one important aspect of the problem:

For some, that may seem like just numbers and graphics. But as the report notes, this has major implications:

“As governments are losing tax revenues, ordinary people end up paying the price: schools and hospitals lose funding and vital public services are cut. Fair taxation of profitable businesses and rich people is central to addressing poverty and inequality through the redistribution of income. Instead, the current global system of tax avoidance redistributes wealth upwards to the richest in society.

That is why civil society organizations, united in the C20 group, together with trade unions, are calling for the actions announced by the OECD to be regarded only as the beginning of a longer and more inclusive process to re-write global tax rules and to ensure that multinationals pay their fair share, in the interest of developed and developing countries around the world.”

Claire Godfrey, head of policy for Oxfam’s Even it Up Campaign said:

“Rich and poor countries alike are haemorrhaging money because multinational companies are not required to pay their fair share of taxes where they make their money. Ultimately the cost is being borne by ordinary people – particularly the poorest who rely on public services and who are suffering because of budget cuts.”

Rosa Pavanelli, general secretary of Public Services International said:

“Public anger will grow if the G20 leaders allow the world’s largest corporations to continue dodging billions in tax while inequality rises, austerity bites and public services are cut.”

Alex Cobham, TJN’s Director of Research, said:

“The corporate tax measures being adopted by the G20 this week are not enough. They will not stop the race to the bottom in corporate taxation, and they will not provide the transparency that’s needed to hold companies and tax authorities accountable. It’s in the G20’s own interest to support deeper reforms to the global tax system.”

Endnotes

The report is available in French and Spanish too, on the Global Alliance for Tax Justice site.

The full paper behind the report is published in the peer-reviewed working paper series of the International Centre for Tax and Development – the leading international and interdisciplinary academic centre in its field, funded by the UK and Norwegian governments:

Full ICTD working paper and the data annex: Cobham Jansky 2015 – Data annexes.

Our new ScaleBEPS page is permanently available on our “Reports” and “Magnitudes” pages and will be updated with latest news on the size of corporate tax cheating.

Related articles

Ireland (again) in crosshairs of UN rights body

Inequality Inc.: How the war on tax fuels inequality and what we can do about it

New Tax Justice Network podcast website launched!

People power: the Tax Justice Network January 2024 podcast, the Taxcast

As a former schoolteacher, our students need us to fight for tax justice

Submission to the UN Special Rapporteur on extreme poverty and human rights’ call for input: “Eradicating poverty in a post-growth context: preparing for the next Development Goals”

17 January 2024

Submission to the Committee on Economic, Social Cultural Rights on the Fourth periodic report of the Republic of Ireland

The Corruption Diaries: our new weekly podcast

Tax Justice Network Arabic podcast #73: ملخص 2023

Publish the names of the companies. Consumers have the real power, but they don’t realise it.

Try to organise consumers.

Thanks Brian. Unfortunately the data is only made public in aggregate and anonymised form, so we don’t have the names. This, of course, is why public country-by-country reporting is required. Only transparency at the company level will provide the accountability to drive change.