Nick Shaxson ■ Loophole USA: the vortex-shaped hole in global financial transparency

Update – Jan 2021 – Historic new U.S. legislation overturns the U.S.’ secret shell company legislation, weakening (though not eliminating) the U.S.’ status as a secrecy jurisdiction.

Update – April 2020. New research based on classified documents reveals an untold and previously secret history of how civil servants in the UK, in partnership with bankers (while excluding law enforcement officials) tailored US-devised money laundering policies to suit the needs of Britain’s financial services industry.

Update – March 2019 – The EU should blacklist the US as a tax haven. Oxfam America.

Update – March 2019 – Russian-Style Kleptocracy Is Infiltrating America. The Atlantic. “New York, Los Angeles, and Miami have joined London as the world’s most desired destinations for laundered money. This boom has enriched the American elites who have enabled it.”

Update – April 2018. Corporate Secrecy Fuels Human Trafficking in United States. Polaris.

Update 13 – Jul 2017 – The U.S. Is a Good Place for Bad People to Stash Their Money in The Atlantic – ‘America vows to promote financial transparency, yet it will let just about anyone register an anonymous shell company’

Update 12 – Jun 2017 – FATCA reciprocity watch: on US single-person LLCs, and more.

Update 11 – Jan 2017: The U.S. hasn’t signed the AEoI Agreement: Reciprocity demanded. Switzerland demands that the United States be less of a tax and secrecy haven.

Update 10, May 2016 – US tax havens – the new Switzerland (Financial Times). “I think the US is already the world’s largest offshore centre”.

Update 9, April 2016: How the U.S. became one of the world’s biggest tax havens – Washington Post.

Update 8: now in The Economist.

Update 7: See also this Bloomberg story entitled The World’s Favorite New Tax Haven Is the United States

Update 6: Jan 2016 – TJN calls for Fatca-like withholding taxes against financial institutions from USA and other financial centres.

Update 5: see our narrative report on how the United States became a secrecy jurisdiction. Also see Tax Analyst’s U.S. Ranks As Top Tax Haven, Refusing To Share Tax Data Despite FATCA

Update 4: see this Oct 2014 technical article entitled Hiding in Plain Sight: how non-US persons can legally avoid reporting under both FATCA and GATCA.

Update 3: more details on U.S. roadblocks from Value Walk, here.

Update 2: more details from Allison Christians, here, from 2013.

Update: Naked Capitalism in the U.S. has published an adapted version of this article, here.

If people stash their wealth or earn income overseas, that is fine with us — just as long as their tax authorities get the information they need to tax that wealth or income according to the law, and as long as money laundering and financial crimes can be effectively tracked, and so on. Where there are cross-border barriers to the instruments of democratic societies, then there is an offshore problem.

The only credible way to provide the necessary information is through so-called automatic information exchange (AIE), where governments make sure the necessary information is available across borders, as a matter of routine.

For years we at the Tax Justice Network were ridiculed for advocating AIE: pie in the sky, many people said. The OECD, the club of rich countries that dominates international rule-making on tax and tax-related information sharing, was for years pushing its so-called Internationally Accepted Standard which was, well, the internationally accepted standard for cross-border information exchange, despite being only slightly better than useless. The message was that we should just accept this, and move on.

How the world has turned since a couple of years ago. The OECD is now in the middle of putting in place a system – known as the Common Reporting Standards (CRS) – to implement automatic information exchange (AIE). The CRS is the first ever potentially global system of AIE, and although it has major shortcomings and loopholes, as we’ve explained on several occasions, it’s potentially a giant step forwards from a largely transparency-free past.

Meanwhile the European Union had been moving ahead with plans to beef up its own, older plans for AIE, notably through amendments to tighten up its loophole-ridden Savings Tax Directive and other initiatives (for an overview of that, see here.) The United States, for its part, has been rumbling forwards with its Foreign Account Tax Compliance Act (FATCA), which is, at least technically speaking from a self-interested U.S. perspective, fairly strong. In fact, the OECD’s CRS is modeled on FATCA.

But – and here comes a big ‘but’ – how do these different initiatives mesh together? Might anything fall between the cracks?

The European Union, for its part, seems to be working hard and in fairly straightforward fashion to get its ducks in line with the CRS, the OECD’s emerging global standard. It will be incorporating a lot of the OECD technical standards into EU law, in cut-and-paste fashion, and will add categories to include in the mix: such as covering the all-important insurance sector more comprehensively than the CRS does, and covering other categories of income and capital including income from employment, directors’ fees, pensions, and ownership of and income from immovable property.

But the United States’ position on meshing FATCA with the global standards? Well, now there’s a story.

That building in the Cayman Islands is still there

President Obama recently gave his State of the Union address, with an eye to his legacy. He’s taken an interest in tax haven issues in the past, declaring in 2009 that Ugland House, a building in the Cayman Islands that then housed some 19,000 companies, was either

“the largest building in the world or the largest tax scam in the world. . . it’s the kind of tax scam that we need to end.”

So he managed to get himself some serious anti-tax haven credentials, at least from a public relations perspective.

But how has the Obama administration shaped up on tax havens since then?

Well, in the details of the emerging global architecture on tax and financial transparency lies something – we’d go so far as to describe it as an international outrage – that is likely to seriously tarnish his legacy. A failure to take this seriously will make wealthy people wealthier and poorer people poorer, and will undermine crime-fighting, in the U.S. and around the world.

USA: ‘we’ll pretend to join in’

The U.S. position has basically been to say ‘we are doing our home-grown FATCA project, and it’s technically similar to the OECD’s CRS, so we don’t need to join the CRS.’ Which, at first glance, looks like a position that could be defensible, depending on the detail.

A crucial part of the detail, however – and this is where the vortex starts to come in – hangs on the all-important question of reciprocity. The United States is extremely keen for other countries to pony up information about U.S. taxpayers hiding their cash offshore and overseas – as it should. But when it comes to reciprocity, or providing information in the other direction, things change.

The U.S. (again, on the surface) has said that is committed to sharing FATCA-related information under so-called Intergovernmental Agreements (IGAs,) which are bilateral deals that stipulate how and in what circumstances the relevant information may be handed over to foreign governments. (There are three basic models: 1A, 1B and 2: only the Model 1A agreements are reciprocal; the Treasury’s U.S. public list of IGAs is here, with the gory details explaining the different models here.)

In May last year the Center for Global Development’s Alex Cobham (now TJN’s Director of Research) wrote a useful blog entitled Joining the Club: The United States Signs Up for Reciprocal Tax Cooperation, welcoming the U.S. commitment to reciprocal information exchange, as far as the announcement went. By November, though, as the details came through, he began to raise the alarm. In a post entitled Has the United States U-Turned on Tax Information Exchange? he wrote:

“A full commitment to reciprocal and automatic, multilateral information exchange, backed by legislation to ensure beneficial ownership information is available, has been replaced by an indication that the United States will seek to provide information in the few bilateral Foreign Account Tax Compliance Act (FATCA) agreements that require it, for which the United States accordingly commits to ‘advocate’ for domestic legal changes that would create the necessary beneficial ownership transparency.

After the midterm elections, the success of such advocacy seems unlikely. But it would be a sad irony if the legacy of an administration that began with such strong rhetoric on shutting down tax havens was to leave the United States as the biggest remaining centre of anonymous company ownership.”

Thus pre-empting today’s blog by quite some time, of course.

What we have now is updated information, source material, and details. Drill down to look at the precise details of what the U.S. is offering, and it the substance seems paper-thin.

The gory details

If you’re not a connoisseur of the details of cross-border financial transparency, this next bit is where we get into the weeds a bit.

The United States is already a tax haven for foreigners, as outlined in detail in Treasure Islands and, more recently, here. To achieve effective reciprocity with other countries it would need to tighten up its rules considerably, and in various ways.

The U.S. Treasury’s Financial Crimes Enforcement Network (FINCEN) seems to be taking a lead on some of the internal stuff to prepare the ground for international co-operation, with new rules entitled “Customer Due Diligence Requirements for Financial Institutions.”

How good are these rules? Well, for starters, on page 45152 Fincen says it

“is proposing rules under the Bank Secrecy Act to clarify and strengthen customer due diligence requirements for: Banks; brokers or dealers in securities; mutual funds; and futures commission merchants and introducing brokers in commodities.”

Our emphasis added. The first thing to notice is that these are just proposals. To get approved, they’re going to have to get this lot past Senator Rand Paul, the combined lobbying power of the Big Four accounting firms and Wall Street banks, and a host of other vested interests.

Then there are the loopholes larded through this document.

For instance, the players identified in the Fincen paragraph above are just a subset of actors in the financial menagerie that is out there. The document continues:

“In addition to input from covered financial institutions, FinCEN sought and received comments on the ANPRM [Advance Notice of Proposed Rule Making] from financial institutions not subject to CIP [Customer Identification Program] requirements, such as money services businesses, casinos, insurance companies, and other entities subject to FinCEN regulations.”

There are no plans to cover these chaps as yet. And this is a problem: in many countries insurance policies, for example, are classic tax evasion and secrecy vehicles — and they’re already carved out.

Then there is the question of trusts, where no useful beneficial ownership information seems to be required. There is this, mostly on p45160:

“There are many types of trusts. While a small proportion may fall within the scope of the proposed definition of legal entity customer (e.g., statutory trusts), most will not. . . . identifying a ‘‘beneficial owner’’ among the parties to such an arrangement for AML purposes, based on the proposed definition of beneficial owner, would not be practical. At this point, FinCEN is choosing not to impose this requirement. “

Our emphasis, again, added. Trusts are a matter of astonishing complexity, slipperiness and importance in the world of offshore secrecy. The world of offshore trusts is a multi-headed hydra, and through these vehicles it is possible to achieve levels of secrecy that are at least as strong as the traditional Swiss banking kind.

There are potentially even more egregious exemptions. Take a look at this corker:

“Financial institutions noted that a requirement to ‘‘look back’’ to obtain beneficial ownership information from existing customers would be a substantial burden. FinCEN proposes that the beneficial ownership requirement will apply only with respect to legal entity customers that open new accounts going forward from the date of implementation. Thus, the definition of ‘‘legal entity customer’’ is limited to legal entities that open a new account after the implementation date.”

Translation: we’ll accept a complete whitewash of everything in the past, because it will be a “burden” on those poor, belaboured financial institutions. And stuff that’s still going on won’t be covered if the account in which it’s happening was opened before then.

Oh, and there is no “implementation date”, anyway. At least for now

Wouldn’t it have been nice if it at least could come up with something strong, then expect it to be watered down at a later stage of law making? But no: they seem to be hobbling themselves from the outset. Is Fincen even trying?

And even then – if Fincen were to close all these loopholes and obtain all this customer information, it doesn’t seem clear to us that it would be authorised to pass it on to the U.S. Internal Revenue Service (IRS), which would be the body that would be mandated to hand over the necessary information to foreign governments that need it to tax or police their wealthy citizens and criminals.

A Europe-based expert we spoke to went as far as to call the U.S.’ adherence to the emerging global transparency standards, just based on what this Fincen document says, ‘farting in the wind.’ This document shows that the US is currently unable under its domestic law to reciprocate with information exchange, because its banks are not required to collect the necessary beneficial ownership information.

So much for the requirements for financial institutions in the U.S. to fish the information out of its customers. Now look at how the (non-)information they do obtain are to be shared out with the U.S.’ foreign partners. Article 6 from one of the U.S. Model IGAs (Intergovernmental Agreements) says:

“Reciprocity. The Government of the United States acknowledges the need to achieve equivalent levels of reciprocal automatic information exchange with [FATCA Partner].”

The U.S. government acknowledges the need to be reciprocal. That’s nice. But will it be?

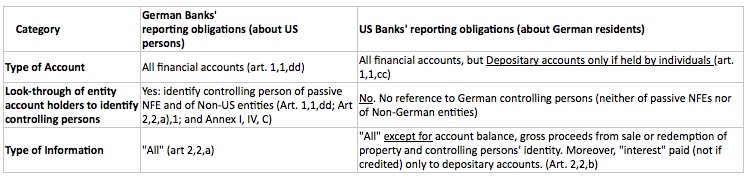

Turn to Article 2, and you get a picture of what the U.S. may obtain from other countries, versus what other countries may obtain from the U.S. Here’s a summary of some of the differences, from TJN’s Andres Knobel. Just look at how thin the US banks’ reporting obligations are about Germans, compared to German banks’ reporting obligations about US persons.

You get the picture. A comparison with more details is available here.

Reciprocity, anyone?

Oh, and then there is the problem that only some countries, but not others, have signed or committed to sign these IGAs.

And then there’s the problem that the U.S. legislation required to tackle this stuff is all over the place, in different legislative nooks and crannies. Jack Blum, a Tax Justice Network Senior Adviser, gave a good overview of an earlier version of this mess to the U.S. Senate Finance Committee in 2008, and he added, in an email to us last week:

“after the current round of IRS budget cuts there is no way the United States could implement Information Exchange. Without the people nothing the law says really matters. Things here are in a real mess.”

Loophole USA: the big one. Will the OECD and its member states – not to mention developing countries – wake up to these issues? And will the United States itself realise that if it doesn’t play ball, others won’t want to play either?

If not, the world’s wealth will flood more upwards and out of sight rather more rapidly than it would have done. That’ll be quite a legacy.

Related articles

The Tax Justice Network’s most read pieces in 2023

Our response to the FATF’s consultation on Guidance on Recommendation 25 on beneficial ownership transparency for legal arrangements

#55 Tous pour une Convention Fiscale Internationale des Nations Unies

Finance climat en Afrique: Une urgence pour les administrations fiscales #54

Strengthening the fight against money laundering: Criminalisation of the EU directive

Can the UN succeed? Top questions about our State of Tax Justice report

Why the world needs UN leadership on global tax policy

The unexploited silver bullet to tackle enablers: mandatory disclosure rules

Split among EU countries over beneficial ownership ruling mirrors rankings on Financial Secrecy Index