John Christensen ■ The (-ve) Value of Jersey to the UK Economy

The G20 summit meeting of world leaders in Brisbane next month will have corporate transparency on the agenda. Unsurprisingly, secrecy jurisdictions are working overtime to deflect attention away from their core activities, such as the provision of secrecy and facilities to escape tax, legally or not.

The G20 summit meeting of world leaders in Brisbane next month will have corporate transparency on the agenda. Unsurprisingly, secrecy jurisdictions are working overtime to deflect attention away from their core activities, such as the provision of secrecy and facilities to escape tax, legally or not.

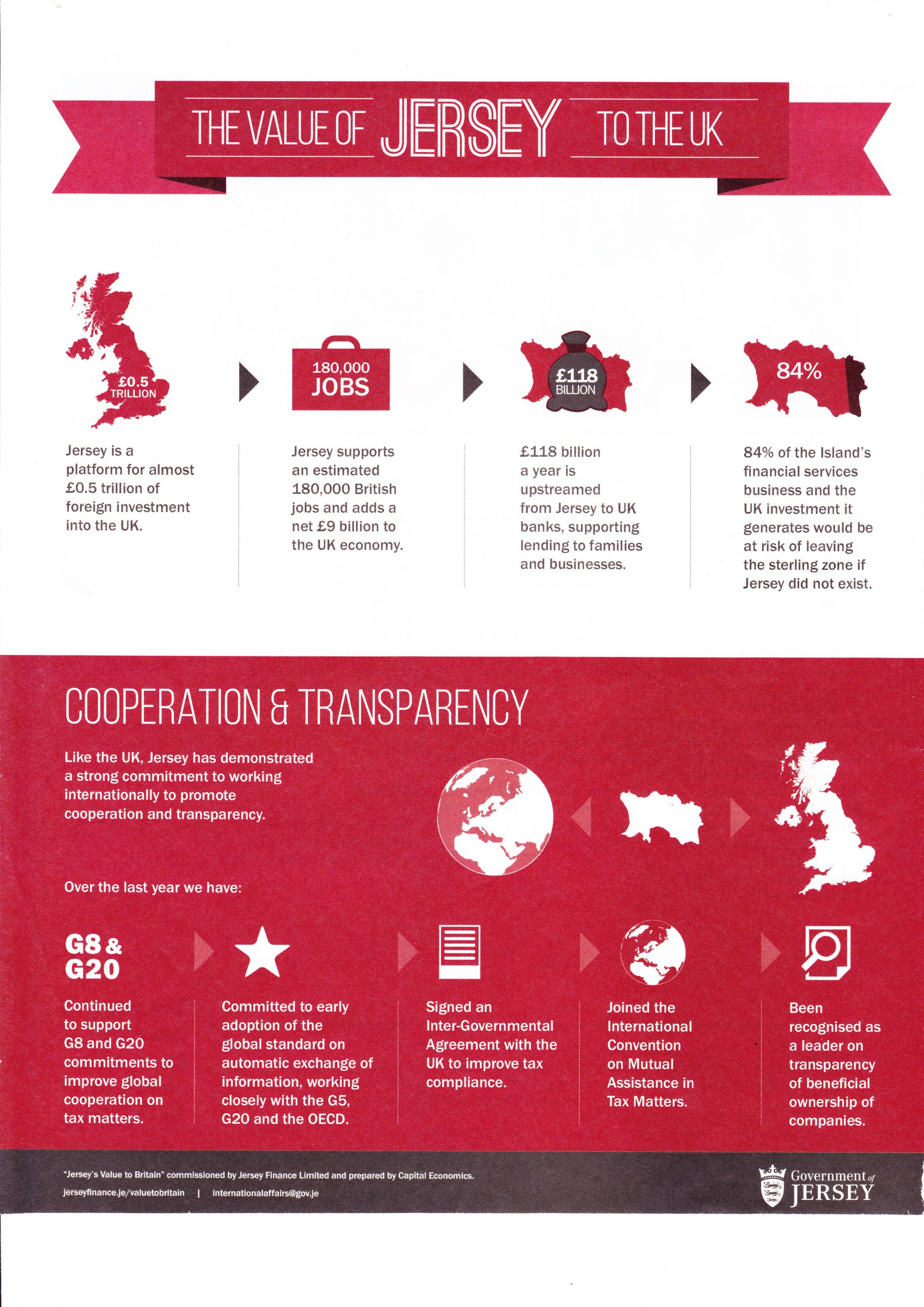

The government of Jersey in conjunction with Jersey Finance, which lobbies for its tax haven finance industry, is now aggressively advertising in selected UK media to promote claims that the island is a major contributor to the UK (click on the image to enlarge).

It makes a number of claims, based heavily on a “study” commissioned from Capital Economics on Jersey’s supposed contribution to the UK. (Jersey has form in commissioning and publicising dodgy studies attacking TJN and its allies.)

We deconstructed that nonsense study here – but there’s more to say.

Anyway, claim number one in the new advertising campaign is that “Jersey is a platform for almost £0.5 trillion of foreign investment into the UK”.

So what does that mean, exactly?

First, almost all of this ‘investment’ would come to the UK anyway. It just happens to be routed via this tiny little island in the cold waters of the English Channel. Why would investors use Jersey as a ‘platform’ to route their investments through? The standard answer with tax havens like Jersey is: predominantly, to strip out taxes. Secrecy can help, too: Jersey is good at that.

And in any case, what kind of investment are we talking about here? Useful investment into new productive activity? Or flighty investment into property speculation, deeply inefficient tax-driven mergers and acquisitions, or private equity takeovers using high levels of debt to leverage tax avoidance possibilities.

This “investment” clearly doesn’t originate in Jersey, so where does it come from? Russia? China? Africa? How much of it is actually UK-sourced capital that has been round-tripped via Jersey structures and dressed up as foreign direct investment, to help those UK investors strip out taxes?

None of these questions are addressed by the Jersey propaganda.

Claim number two is equally baseless: “Jersey supports an estimated 180,000 British jobs and adds a net £9 billion to the UK economy.”

Not bad for an island a mere nine miles by five with an economy valued at £3.7 billion in 2013 which has flat-lined for much of the last decade.

But now let’s ask: what is the basis of this claim? What do the words “supports” and “adds” mean here?

Once again, the British jobs “supported” by Jersey would exist anyway. It’s just that the owners of and investors in the companies that provide those jobs can use Jersey to strip taxes out of their offering, and in some cases hide their identities.

Far more meaningful than Jersey’s claims to “support” all these British jobs is the fact that cutbacks in public spending in the UK, which could easily be avoided were the UK government to take strong measures to tackle the UK’s tax gap, are causing far more job losses and will harm the UK economy to a far greater extent that the hollow claims of Jersey Finance.

On to claim number three, which is that “£118 billion a year is upstreamed from Jersey to UK banks, supporting lending to families and businesses.” Now this doesn’t originate from hard-saving folk of Jersey, many of whom are hard pushed to survive the island’s eye-watering cost of living.

This claim is another way of saying that bankers use Platform Jersey as a base for cross-border lending, because it helps them book their profits there. Happy days for the bankers – not such good news for the citizens of the UK. Plenty of this ‘upstream’ money comes from UK residents and UK expatriates, banking in Jersey. They would nearly all bank in the UK, if the offshore option weren’t available. This “£118 billion a year” is not new money: it is merely a measure of the distortion that Jersey puts on British banking.

And so on to claim number four:

“84% of the island’s financial services business and the UK investment it generates would be at risk of leaving the sterling zone if Jersey did not exist.”

Really? They say that – of course they would: they all do – but it is an astonishing claim, and a very exact number.

This has the all too familiar tax haven ring of “if you try to take measures against us we’ll simply up-sticks to Luxembourg, or Dublin, or wherever else we can get away with our tax dodging shenanigans”.

To be precise, it’s a threat – a generic threat that we’ve heard so many times before. It routinely panicks politicians.

But the truth is, the threat is empty: as we explain above, and all over the rest of this website, the benefits that tax havens like Jersey say they bring are largely hot air – and the associated costs are high.

As Warren Buffett and others have argued time and again, if there’s a genuine business opportunity at hand, investors will go for it, and they won’t need to be at the receiving end of corporate subsidies and tax breaks. In survey after survey, investors go in for places that offer good infrastructure, a healthy and educated workforce, good courts and the rule of law, and so on. Except for the flightiest, least useful, least locally embedded, and most rent-seeking kind of investment, tax comes low down on the list of priorities.

In short, the good stuff would come anyway. The stuff that only come because of tax breaks via Jersey is, almost by definition, the useless stuff that nobody needs.

This flighty, useless, rent-seeking sort of investment tends to seek out the dodgier offshore centres which don’t require transparency of beneficial ownership and resist effective and multilateral information exchange with the poorer countries from where much of the capital originates in the first place.

Related articles

New Tax Justice Network podcast website launched!

The Corruption Diaries: our new weekly podcast

Tax Justice Network Arabic podcast #73: ملخص 2023

New report on how to fix beneficial ownership frameworks, so they actually work

Criminosos na Amazônia lavam dinheiro nos EUA: the Tax Justice Network Portuguese podcast #55

The People vs Microsoft: the Tax Justice Network podcast, the Taxcast

Como impostos podem promover reparação: the Tax Justice Network Portuguese podcast #54

Drug War Myths, part 2: the Tax Justice Network podcast, the Taxcast

New Tax Justice Network Data Portal gives unparalleled access to wealth of data on tax havens