John Christensen ■ Caffe Nero: your unpaid taxes would have helped pay for my father’s hospital care

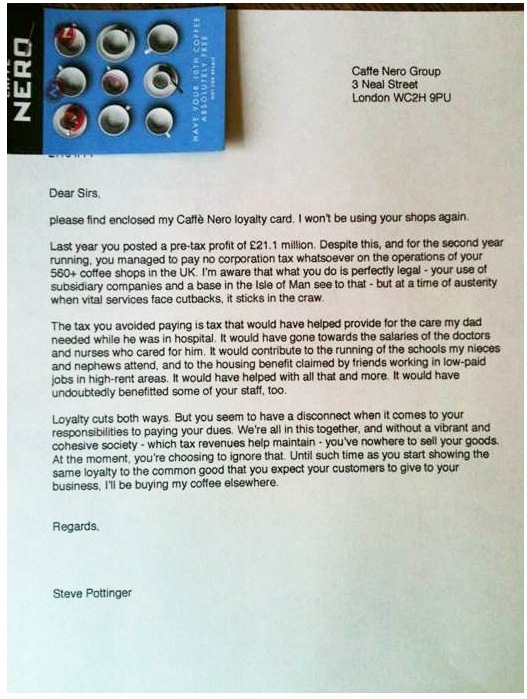

A couple of years ago poet Steve Pottinger penned this eloquent reaction to the anger he felt about Starbucks’ corporate tax avoidance. In similar vein he’s now sent the following letter to the management of Caffe Nero.

Caffe Nero Group Limited posted pre-tax profits of £19.1 mn and £21.1 mn in 2012 and 2013 respectively. But no corporation tax was payable on those profits. Why not? Largely, we suspect because they have shifted their profits to associated companies in the Isle of Man and Luxembourg.

We join Steve in calling for a boycott of Caffe Nero, but we also call on the UK government to ensure that effective measures are taken to curtail tax avoidance by all transnational companies.

Related articles

New Tax Justice Network podcast website launched!

The Corruption Diaries: our new weekly podcast

Tax Justice Network Arabic podcast #73: ملخص 2023

New report on how to fix beneficial ownership frameworks, so they actually work

Criminosos na Amazônia lavam dinheiro nos EUA: the Tax Justice Network Portuguese podcast #55

The People vs Microsoft: the Tax Justice Network podcast, the Taxcast

Drug War Myths, part 2: the Tax Justice Network podcast, the Taxcast

New Tax Justice Network Data Portal gives unparalleled access to wealth of data on tax havens

Strengthening the fight against money laundering: Criminalisation of the EU directive