John Christensen ■ HSBC, money-laundering and Swiss regulatory deterrence

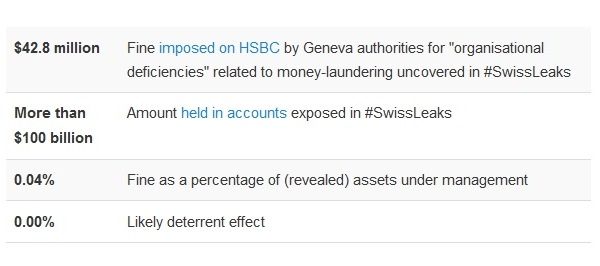

Number-crunching, à la Private Eye: the case of HSBC and its Swiss fine for “organisational deficiencies” in relation to money-laundering.

Number-crunching, à la Private Eye: the case of HSBC and its Swiss fine for “organisational deficiencies” in relation to money-laundering.

- $42.8 million Fine imposed on HSBC by Geneva authorities for “organisational deficiencies” related to money-laundering uncovered in #SwissLeaks

- More than $100 billion Amount held in accounts exposed in #SwissLeaks

- 0.04% Fine as a percentage of (revealed) assets under management

- 0.00% Likely deterrent effect

Not all the assets under management were laundered, of course. Far from it, we must hope. But the “organisational deficiencies” – including reassuring clients that no information would reach their home authorities, or using offshore accounts to circumvent disclosure requirements – represent risks that applied to the whole operation.

To put it another way, the fine is about a fifth of the £135 million in tax that HMRC recovered in the UK alone.

Even the prosecutor imposing the fine was embarrassed, and “launched a stinging attack” on the Swiss law that apparently prevented anything within yodeling distance of being a deterrent.

Cross-posted from Uncounted

Related articles

The secrecy enablers strike back: weaponising privacy against transparency

Privacy-Washing & Beneficial Ownership Transparency

26 March 2024

Ireland (again) in crosshairs of UN rights body

New Tax Justice Network podcast website launched!

People power: the Tax Justice Network January 2024 podcast, the Taxcast

As a former schoolteacher, our students need us to fight for tax justice

Submission to the UN Special Rapporteur on extreme poverty and human rights’ call for input: “Eradicating poverty in a post-growth context: preparing for the next Development Goals”

17 January 2024

Submission to the Committee on Economic, Social Cultural Rights on the Fourth periodic report of the Republic of Ireland

El secreto fiscal…tiene cara de mujer: January 2024 Spanish language tax justice podcast, Justicia ImPositiva