Naomi Fowler ■ Estimates on illicit flows to and from developing countries

Our friends at Global Financial Integrity have released their latest report on what they estimate to be the latest figures from 150 countries on illicit financial flows to and from developing countries for the period 2005-2014. Most of these flows arise from fraudulent trade mis-invoicing which, as they point out, adversely affects the lives of real people:

“The massive flows of illicit capital shown in this study represent diversions of resources from their most efficient social uses in developing economies and are likely to adversely impact domestic resource mobilization and hamper sustainable economic growth.”

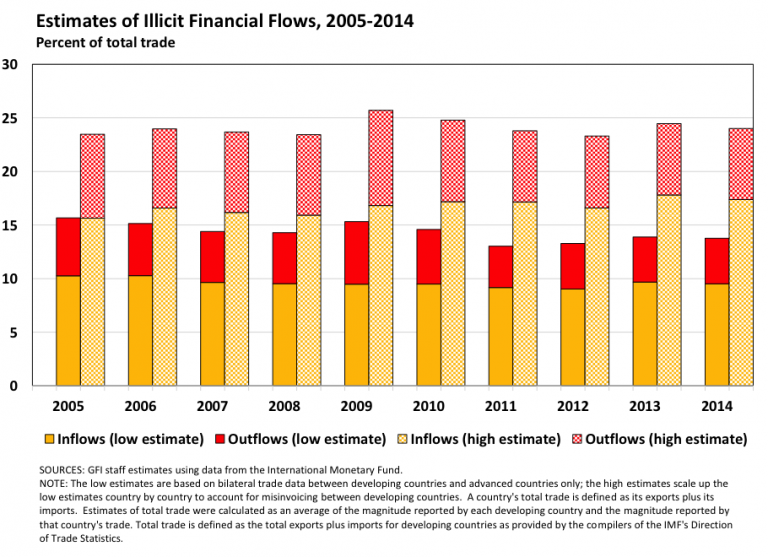

Interestingly, in addition to the estimated outflows GFI has looked at, this report also estimates illicit inflows to developing countries:

“Illicit inflows frequently occur when imports are under-invoiced for the purpose of evading customs duties and VAT taxes. The magnitude of estimated illicit inflows in the latest year (2014) ranges from $1.4 to $2.5 trillion. This large range reflects the fact that more precise calculations are difficult to make using available data.”

Available data, and access to it is always a challenge to such analysis. This is why it’s so important that governments insist multinational companies publicly disclose their revenues, profits, losses, sales, taxes, subsidiaries and staff levels on a country-by-country basis, otherwise known as country-by-country reporting, something the Tax Justice Network has been calling for since 2003. As they comment in their report, Global Financial Integrity has a long track record of calling for improvements to trade data collection and publication:

“Years of experience with businesses and governments in the developing world have taught us that the decision to bring illicit flows into a particular developing country often marks only the first phase of a strategy to subsequently move funds out of the country. Additionally, such factors as the misinvoicing of services and intangibles, same-invoice faking, and cash movements related to many criminal activities tend to affect outflows from developing countries more than inflows to those countries. If so, we might surmise that the omission of such factors from even the best available data (used by GFI and other researchers) might mean that our figures on outflows are underestimated to a larger degree than our inflows are overestimated. In other words, the excess of estimated inflows over outflows might be exacerbated by limitations of the merchandise trade data used here and in related research. Much work remains to be done in coming to grips with estimates of both outflows and inflows.”

Here are some of the highlights of the report:

- US$620 billion-970 billion drained from developing world in 2014, primarily through trade fraud

- Illicit inflows similarly harmful and estimated at $1.4-$2.5 trillion in 2014

- Combined, illicit outflows and inflows accounted for 14.1-24.0 percent of total developing country trade over 2005-2014

- Sub-Saharan Africa Still Suffers Largest Illicit Outflows as percent of GDP

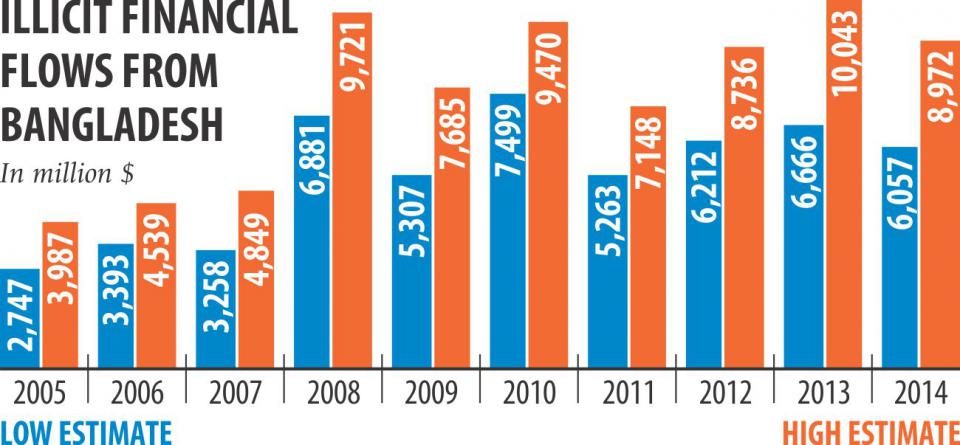

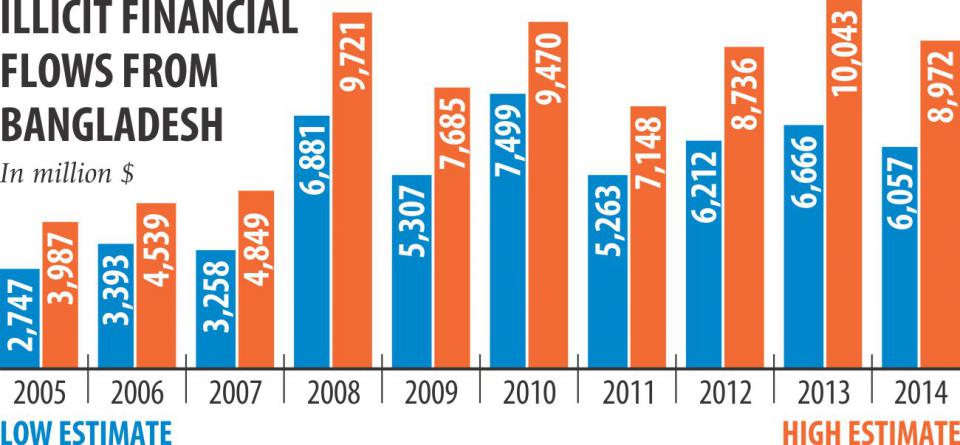

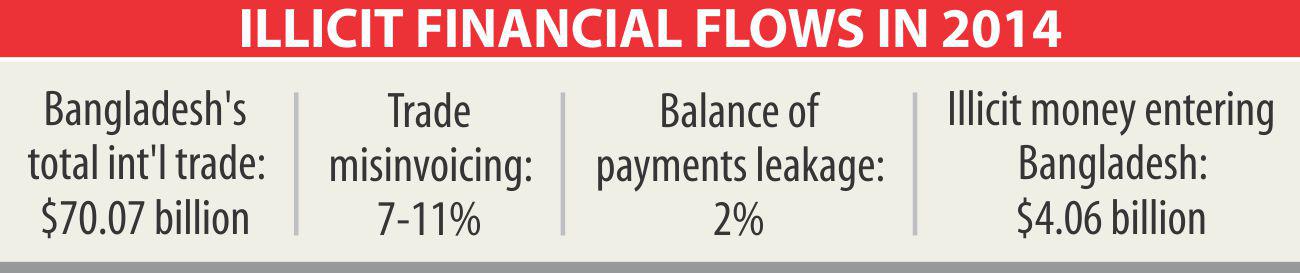

And the Daily Star in Bangladesh has reported on its front page that according to the Global Financial Integrity estimates the country lost between $6 billion and $9 billion to illicit money outflows in 2014 alone. It lost an estimated $75 billion through trade misinvoicing and other unrecorded outflows between 2005 and 2014.

That’s quite simply devastating:

And here’s another graph from Bangladesh newspaper the Daily Star’s front page:

There are estimates on 149 other countries to look at. You can read the full report here.

We agree wholheartedly with the policy recommendations made by Global Financial Integrity to tackle this ‘bleeding’:

- Governments should establish public registries of verified beneficial ownership information on all legal entities, and all banks should know the true beneficial owner(s) of any account in their financial institution.

- Government authorities should adopt and fully implement all of the Financial Action Task Force’s (FATF) anti-money laundering recommendations; laws already in place should be strongly enforced.

- Policymakers should require multinational companies to publicly disclose their revenues, profits, losses, sales, taxes paid, subsidiaries, and staff levels on a country-by-country basis.

- All countries should actively participate in the worldwide movement towards the automatic exchange of tax information as endorsed by the OECD and the G20.

- To curtail trade misinvoicing:

- customs agencies should treat trade transactions involving a tax haven with the highest level of scrutiny;

- governments should significantly boost their customs enforcement by equipping and training officers to better detect intentional misinvoicing of trade transactions, particularly through access to real-time world market pricing information at a detailed commodity level; and,

- Governments should sign on to the Addis Tax Initiative to further support efforts to curb IFFs as a key component of the development agenda.

Related articles

New Tax Justice Network podcast website launched!

Overturning a 100 year legacy: the UN tax vote on the Tax Justice Network podcast, the Taxcast

The People vs Microsoft: the Tax Justice Network podcast, the Taxcast

New Tax Justice Network Data Portal gives unparalleled access to wealth of data on tax havens

Convenção na ONU pode conter $480 bi de abusos fiscais #52: the Tax Justice Network Portuguese podcast

Taxes, a matter of life or death

Shareholders to vote on tax transparency as report raises serious questions for Canada’s largest alternative asset manager

Tax saves lives: the Tax Justice Network podcast, the Taxcast

Tax Justice Network letter to King Charles III – Full Text

Any publication available on that great example of transfer pricing Compass Group PLC based in Chertsey on Thames! yet bases all over world.