Alex Cobham ■ The UK’s North Sea oil revenues: Giving it away?

New analysis of the UK’s North Sea oil and gas suggests that the combination of tax giveaways by the government, and aggressive avoidance by multinationals, means that the country may actually be subsidising the extraction of its natural resources. And this at a time of continuing ‘austerity’ measures, that a UN treaty body has harshly criticised for driving poverty and inequality, undermining citizens’ human rights.

An important shift over the last two decades has been the emergence of active civil society movements in many countries focused on the natural resource revenues obtained by their governments: whether sufficient revenues are obtained, and how they are spent. Sadly, such movements have been largely absent in high-income countries – and nowhere more obviously than the UK.

The UK provided the original base for the Extractive Industries Transparency Initiative, launched by Tony Blair back in 2002. But a failure to obtain appropriate revenues for the state was seen as a problem of developing countries and corruption, rather than what it is – an issue of basic state accountability in the face of aggressive multinationals. And so for me than a decade, the UK did not even join its own initiative, and only became a candidate country in 2014. It is currently listed as ‘implementing EITI, not yet compliant’.

A new report published today by the International Transport Workers’ Federation (ITF) sets out a series of shocking statistics on the UK’s failure to obtain an appropriate share of its own resource wealth. Among them, these stand out:

- In 2014, UK consumers paid 6 times more tax on petrol, excluding VAT, than the North Sea oil and gas industry paid on all taxes related to production.

- Chevron’s effective tax rate in 2014 on earnings from North Sea production was 5.4%; statutory tax rates (of various types) on oil and gas should have totalled 61-82%.

- In 2014, 3 (Shell, BP & Total) of the top 4 North Sea producers produced more than £4.3 billion worth of oil and gas and received over £300 million in net tax refunds.

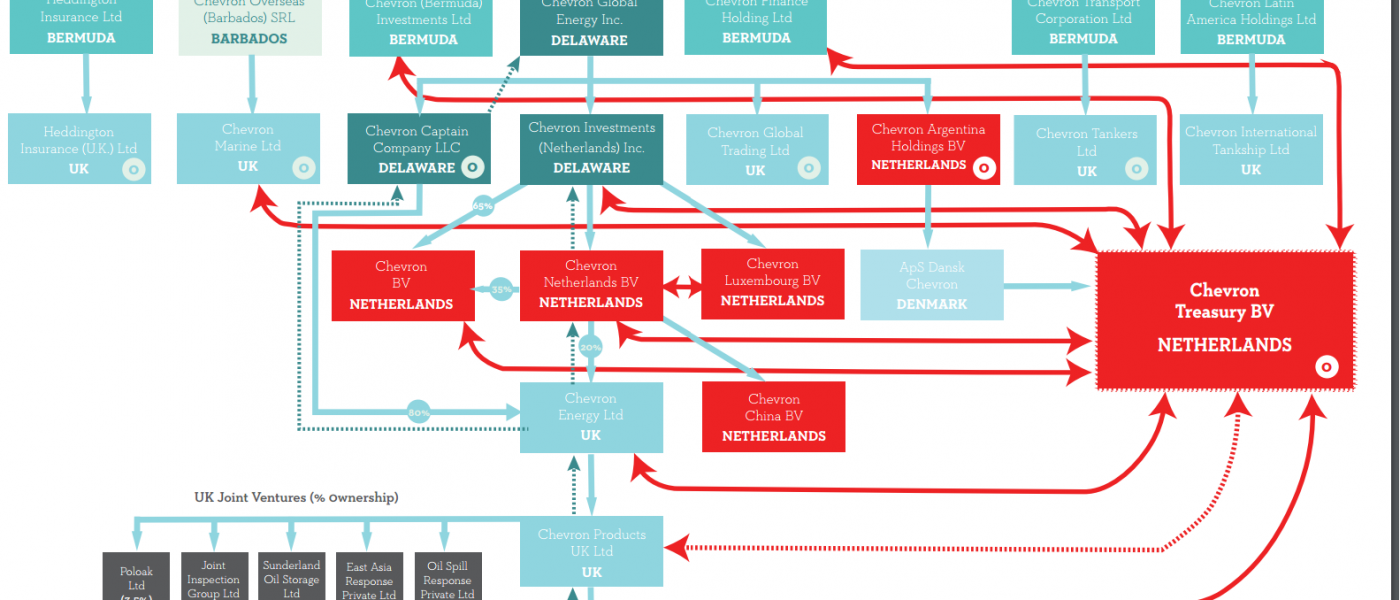

The ITF argue that while the oil sector has successfully lobbied for and won huge tax breaks from the UK government, the companies involved continued to pursue aggressive tax avoidance as standard practice. The Chevron report (see graphic for UK structure, click to enlarge) provides a detailed case study of tax dodging tactics which are replicated by others, particularly Nexen – on which the Times had a frontpage splash yesterday, using ITF analysis to show that the Chinese government-backed company received tax credits of £2 billion.

The ITF analysis covers 2014, when oil prices were still relatively high. Since then the oil sector as a whole has become a net tax drain on the UK budget, not including direct subsidies. On that basis, the ITF conclude that UK taxpayers are now likely to be subsidising the world’s largest oil companies to exploit the country’s natural resources.

The report, and much more, can be found at http://www.chevrontax.info/. We highly recommend a visit – and if you’re in the UK, you may want to raise this with your representatives. (If you’re in Scotland in particular, you want to consider what this analysis entails for yesterday’s data showing a large, implicit deficit for an independent Scotland. Would an independent Scotland subsidise the oil and gas sector? In the absence of independence, should the UK be doing it?)

Related articles

🔴Live: UN tax negotiations – First Session

What to know and expect ahead of this week’s UN tax negotiations

The secrecy enablers strike back: weaponising privacy against transparency

Privacy-Washing & Beneficial Ownership Transparency

26 March 2024

Ireland (again) in crosshairs of UN rights body

Tax policy and gender disparity: A call to action on International Women’s Day 2024

Policy research conference: How a UN Tax Convention can address inequality in Europe and beyond

The IMF’s anti-money laundering strategy review is promising, but it all comes down to implementation

Inequality Inc.: How the war on tax fuels inequality and what we can do about it

Proposal for ‘Business in Europe: Framework for Income Taxation’ (BEFIT): A wrong turn in the right direction

2 February 2024