Naomi Fowler ■ The #LuxLeaks whistleblowers verdict: our statement

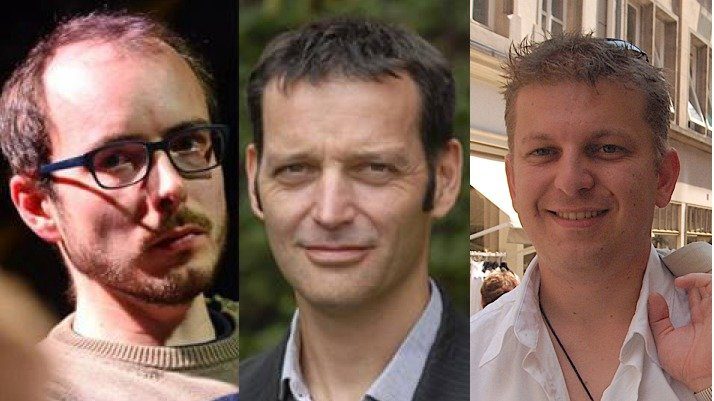

[vc_row][vc_column][vc_column_text]The verdicts are in. Today the Luxembourg court sentenced Antoine Deltour to 12 month suspended jail time and a €1,500 fine. Raphaël Halet is sentenced to 9-month suspended jail time and a 1,000 € fine. The journalist Edouard Perrin was acquitted. A statement from Antoine Deltour’s support committee is here.

Antoine Deltour said:

“Sentencing the citizens at the origin of LuxLeaks revelations is equivalent to sentencing the regulatory advancements which have been triggered by these revelations and which have been widely acclaimed across Europe. This is also a warning towards future whistleblowers, which is detrimental to citizen’s information and the good functioning of the democracy.”

These whistleblowers are heroes who acted in the public interest, the public interest of all the other countries in the EU and beyond, which have lost enormous tax revenues to the secret deals drawn up by the Luxembourg state; but also the public interest of Luxembourg itself, where citizens are now able to see how far the state has corrupted itself in the interests of poaching the tax base from activities that take place elsewhere.

It is our position that Luxembourg itself has been on trial in this case, and has been found guilty on multiple counts.

We must ask too, in whose interest has the trial of these heroes been? Not the citizens and domestic companies of Luxembourg, for whom no secret deals were on offer. Not the Luxembourg state, which should be addressing the shocking failures of governance that have been revealed. No, this trial appears to have been carried out at the prompting of PwC, the big 4 accounting firm who led the others in exploiting these secretive opportunities for abuse. Where are PwC and the rest of the big 4 today? Do they welcome the prosecution of whistleblowers? Or do they hang their heads in shame for the tax abuses they have commissioned and profited from?

The Tax Justice Network now calls on the big 4 firms to present aggregate data annually, showing the alignment or otherwise of their clients’ declared profits with the location of their real economic activity – and the tax implications. They should also support their clients to publish individually the country-by-country reporting that will show which companies are playing by the rules, and which are cheating the system.

END[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/1″][vc_raw_js]

JTNDYmxvY2txdW90ZSUyMGNsYXNzJTNEJTIydHdpdHRlci10d2VldCUyMiUyMGRhdGEtbGFuZyUzRCUyMmVuJTIyJTNFJTNDcCUyMGxhbmclM0QlMjJlbiUyMiUyMGRpciUzRCUyMmx0ciUyMiUzRURvZXMlMjAlM0NhJTIwaHJlZiUzRCUyMmh0dHBzJTNBJTJGJTJGdHdpdHRlci5jb20lMkZwd2NfcHJlc3MlMjIlM0UlNDBwd2NfcHJlc3MlM0MlMkZhJTNFJTIwaGF2ZSUyMGFueSUyMGNvbW1lbnQlMjBvbiUyMHRvZGF5JTI2JTIzMzklM0JzJTIwJTNDYSUyMGhyZWYlM0QlMjJodHRwcyUzQSUyRiUyRnR3aXR0ZXIuY29tJTJGaGFzaHRhZyUyRkx1eExlYWtzJTNGc3JjJTNEaGFzaCUyMiUzRSUyM0x1eExlYWtzJTNDJTJGYSUzRSUyMHRyaWFsJTIwdmVyZGljdCUzRkhlcmUlMjYlMjMzOSUzQnMlMjBvdXIlMjBzdGF0ZW1lbnQlMjBjYWxsaW5nJTIwb24lMjB0aGUlMjBCaWclMjA0JTIwdG8lMjBhY3QlMjAlM0NhJTIwaHJlZiUzRCUyMmh0dHBzJTNBJTJGJTJGdC5jbyUyRjVqTWtzYlRhRjQlMjIlM0VodHRwcyUzQSUyRiUyRnQuY28lMkY1ak1rc2JUYUY0JTNDJTJGYSUzRSUzQyUyRnAlM0UlMjZtZGFzaCUzQiUyMFRheCUyMEp1c3RpY2UlMjBOZXR3b3JrJTIwJTI4JTQwVGF4SnVzdGljZU5ldCUyOSUyMCUzQ2ElMjBocmVmJTNEJTIyaHR0cHMlM0ElMkYlMkZ0d2l0dGVyLmNvbSUyRlRheEp1c3RpY2VOZXQlMkZzdGF0dXMlMkY3NDgxNjQ2NzM0MTQwNDE2MDAlMjIlM0VKdW5lJTIwMjklMkMlMjAyMDE2JTNDJTJGYSUzRSUzQyUyRmJsb2NrcXVvdGUlM0UlMEElM0NzY3JpcHQlMjBhc3luYyUyMHNyYyUzRCUyMiUyRiUyRnBsYXRmb3JtLnR3aXR0ZXIuY29tJTJGd2lkZ2V0cy5qcyUyMiUyMGNoYXJzZXQlM0QlMjJ1dGYtOCUyMiUzRSUzQyUyRnNjcmlwdCUzRQ==

[/vc_raw_js][/vc_column][/vc_row][vc_row][vc_column width=”1/1″][vc_column_text]Via e-mail, we’ve had a couple of other statements, from other organisations.

First, Christian Aid:

Wednesday 29th June 2016

PROTECT WHISTLEBLOWERS & END SECRECY AROUND MULTINATIONALS’ TAX: CHRISTIAN AID

As whistleblowers who exposed multinationals’ cosy tax deals were sentenced in Luxembourg today, Christian Aid said the public should thank, not punish them.

“These whistleblowers deserve our thanks for exposing the scandalous ‘sweetheart’ tax deals between governments and multinationals,” said Toby Quantrill, Christian Aid’s Principal Adviser on Economic Justice.

“The deals were deeply unfair to the millions of ordinary people and small companies who have no choice but to pay their taxes and who need the hospitals, schools and many other public services funded by tax.

”Even though the sentences handed down today were suspended, they send completely the wrong signal about what the whistleblowers did. For society at large, they were heroes, not villains.”

Mr Quantrill added: “One of the many disturbing aspects of this case is that more than a year after LuxLeaks, very little has changed. We still don’t know what taxes multinationals pay in each country, or what cosy deals they may have done with European governments, including the UK’s.

“Despite the outrage around scandals such as LuxLeaks, we remain reliant on people prepared to risk prison to reveal information which should already be in the public domain. That is a further scandal.”

However in an encouraging development yesterday (Tuesday 28th June), UK MPs came very close to approving a reform that would help curb multinational tax dodging around the world.

The move almost won House of Commons approval, after 273 MPs from all the major parties voted in favour – only 22 short of the number needed.

The Chancellor George Osborne is now facing calls to use his power to ensure the ‘ShowMeTheMoney’ amendment to the Finance Bill becomes law.

It would require multinational companies above a certain size to publish information that they already have to give the UK taxman, about key details of their business in each country where they operate.

Such information can reveal suspicious patterns which warrant further investigation and may reflect a firm’s failure to pay its fair share of tax in all the countries where it operates.

Caroline Flint, MP for Don Valley, tabled the amendment, which was in turn backed by MPs from the Conservatives, UKIP, the Liberal Democrats, Labour, the Scottish Nationalists, the Greens, Plaid Cymru and the SDLP. Others supporting the amendment included Christian Aid, Oxfam, Save the Children, ActionAid and the Tax Justice Network.

Second, Eurodad:

Campaigners condemn punishment of Luxleaks whistleblowers who acted in the public interest

Wednesday June 29 2016

Tax Justice campaigners today condemned the punishment of Antoine Deltour and Raphaël Halet – two whistleblowers who were instrumental in exposing the infamous ‘Luxleaks’ scandal.

Mr Deltour was given a 12 month suspended prison sentence and a €1500 fine. Mr Halet was given a 9 month suspended prison sentence and a €1000 fine. French journalist Edouard Perrin was acquitted.

All three men helped expose the secret sweetheart deals signed by the Luxembourg government that allowed numerous multinational corporations to reduce their tax bills dramatically, in some cases to less than 1%.

Tove Ryding, Tax justice Coordinator at the European Network on Debt and Development (Eurodad) said: “The sentences imposed on these men are a complete disgrace and an indictment of the system that has condemned them. They acted in the public interest and deserve thanks and protection from prosecution. They revealed the secret tax deals that allowed huge corporations to pay next to nothing to the public purse. These kind of deals mean both developed countries, and the poorest nations in the world, lose billions every year.

“This information should not have been secret in the first place. There is no reason why citizens should not be allowed to know where multinational corporations do their business and where they pay their taxes.”

More than 200,000 people have shown their support for Antoine Deltour through this online petition alone: https://www.change.org/p/support-antoine-deltour-luxleaks?lang=en-GB

Ryding said: “We are calling for protection for all whistleblowers so that what happened to these three men today can never happen again. We also believe it is about time for the politicians to make multinational corporations publish the numbers showing where they make their profits and where they pay their taxes.”

ENDS

[/vc_column_text][/vc_column][/vc_row]

Related articles

The secrecy enablers strike back: weaponising privacy against transparency

Privacy-Washing & Beneficial Ownership Transparency

26 March 2024

Ireland (again) in crosshairs of UN rights body

Tax policy and gender disparity: A call to action on International Women’s Day 2024

Policy research conference: How a UN Tax Convention can address inequality in Europe and beyond

The IMF’s anti-money laundering strategy review is promising, but it all comes down to implementation

Inequality Inc.: How the war on tax fuels inequality and what we can do about it

Proposal for ‘Business in Europe: Framework for Income Taxation’ (BEFIT): A wrong turn in the right direction

2 February 2024

Formulary apportionment in BEFIT: A path to fair corporate taxation

31 January 2024

These men are heroes, and should be honored, not punished!

I read in Feedblitz: ‘It’s time to reward tax whistleblowers’

Who would judge?

Can national courts be relied on?

Who funds the rewards?

Can a viable method be devised?

The soft underbellies of dodgers are their citizen workers.

.