Nick Shaxson ■ What if tax reform was a fundamental human right?

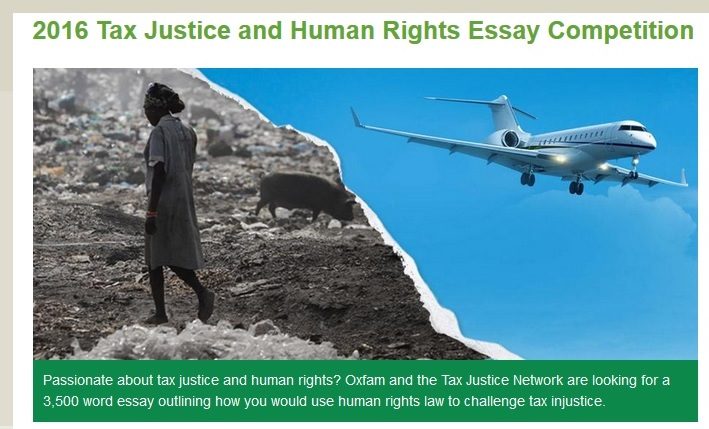

In January we blogged our 2016 Tax Justice and Human Rights essay competition, in partnership with Oxfam. It was a competition aimed at legal students and professionals, seeking ideas on how human rights law can be used in the fight against tax dodging.

In January we blogged our 2016 Tax Justice and Human Rights essay competition, in partnership with Oxfam. It was a competition aimed at legal students and professionals, seeking ideas on how human rights law can be used in the fight against tax dodging.

The winning student submission was from Megan Jones, a PhD Candidate at the Queensland University of Technology. She has written a joint article in The Conversation, with Kerrie Sadiq, a TJN Senior Adviser who is also Jones’ supervisor. Its title is What if tax reform was a fundamental human right?

The introduction states:

“Most would argue that tax revenue should be sufficient to meet basic economic and social needs of the community. But how does a community determine what these basic economic and social needs should be? One way is by using a human rights framework. This can provide guidance for both developing and developed countries considering tax reform.”

Now read on.

For our tax justice and human rights permanent page.

Related articles

Taxing Ethiopian Women for Bleeding

Tax justice and the women who hold broken systems together

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

The tax justice stories that defined 2025

Let’s make Elon Musk the world’s richest man this Christmas!

2025: The year tax justice became part of the world’s problem-solving infrastructure

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025