Nick Shaxson ■ New IMF research: tax affects inequality; inequality affects growth

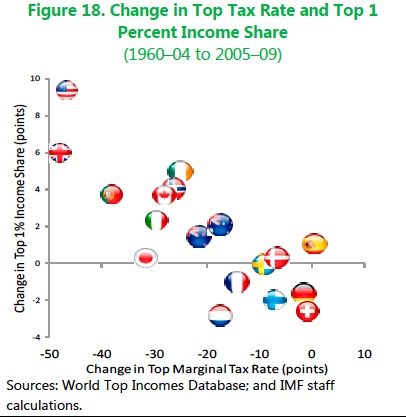

This new graph from the IMF is just the latest piece of research that follows on from the in-depth work of Thomas Piketty and others looking at the relationship between top income tax rates and inequality. The graph here makes the point adequately. Put crudely, the lower the top tax rate, the more inequality will rise.

This new graph from the IMF is just the latest piece of research that follows on from the in-depth work of Thomas Piketty and others looking at the relationship between top income tax rates and inequality. The graph here makes the point adequately. Put crudely, the lower the top tax rate, the more inequality will rise.

The IMF discussion note is called Causes and Consequences of Income Inequality: A Global Perspective, and it goes far beyond tax. It was summarised, not inaccurately, in the Pacific Standard, thus:

“The IMF Confirms That ‘Trickle-Down’ Economics Is, Indeed, a Joke”

Among other important things, the IMF report looks at the relationship between inequality and growth:

“If the income share of the top 20 percent increases by 1 percentage point, GDP growth is actually 0.08 percentage point lower in the following five years, suggesting that the benefits do not trickle down. Instead, a similar increase in the income share of the bottom 20 percent (the poor) is associated with 0.38 percentage point higher growth.”

In other words, the more inequality, the lower the growth. Not a new conclusion, but useful new global data.

Why might higher inequality harm growth? Well, the IMF outlines a few reasons:

- Inequality damages poorer households and makes them less able to contribute

- Reduces demand in an economy, because the rich spend less of the income than the poor do

- Higher inequality seems to be associated with more frequent and bigger financial crises, particularly due to higher borrowing (to “keep up with the Joneses”)

- Inequality contributes to global macroeconomic imbalances

- Extreme inequality may intensify grievances, foster conflicts, and make dispute resolution harder

- Inequality can create worse economic policies. For example, “enhanced power by the elite could result in a more limited provision of public goods that boost productivity and growth, and which disproportionately benefit the poor”

- In unequal countries, growth is less efficient in lowering poverty, which harms growth.

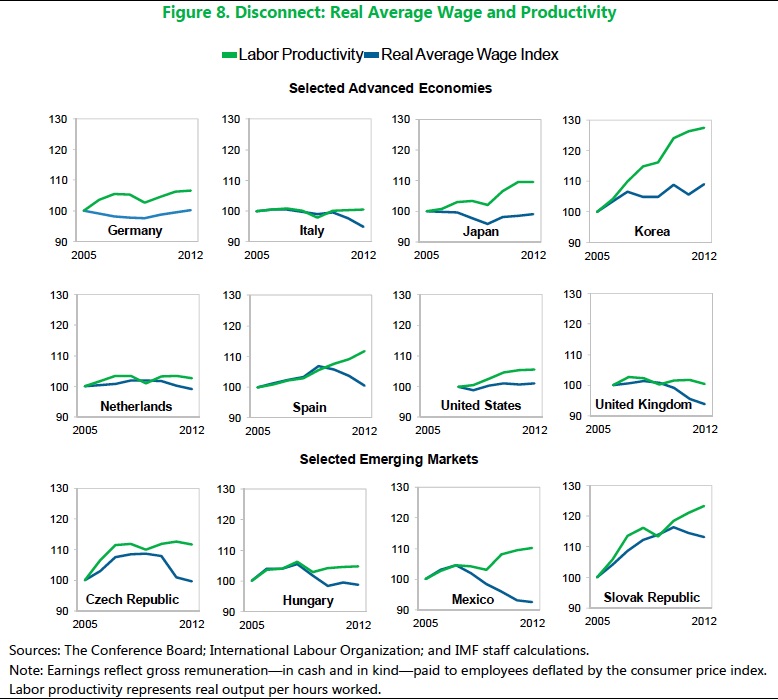

Finally, a graph looking at how workers have been collecting a steadily lower share of the spoils (and capital-owners have therefore been hoovering up a greater share) over a relatively short time-frame, in country after country.

There’s also a nice little graph on corporate taxes, which Fools’ Gold has picked up on.

Enough said, for now.

Related articles

Ireland (again) in crosshairs of UN rights body

New Tax Justice Network podcast website launched!

People power: the Tax Justice Network January 2024 podcast, the Taxcast

As a former schoolteacher, our students need us to fight for tax justice

Submission to the UN Special Rapporteur on extreme poverty and human rights’ call for input: “Eradicating poverty in a post-growth context: preparing for the next Development Goals”

17 January 2024

Submission to the Committee on Economic, Social Cultural Rights on the Fourth periodic report of the Republic of Ireland

The Corruption Diaries: our new weekly podcast

Tax Justice Network Arabic podcast #73: ملخص 2023

ESCOLA DE HERÓIS TRIBUTÁRIOS #56: the Tax Justice Network Portuguese podcast