Nick Shaxson ■ Picture of the day: the global wealth pyramid

Credit Suisse’s new Global Wealth Report is out. As always, it contains a ream of useful data. For instance, it estimates that global household wealth reached US$263 trillion in mid-2014, up from $117 trillion in 2000:

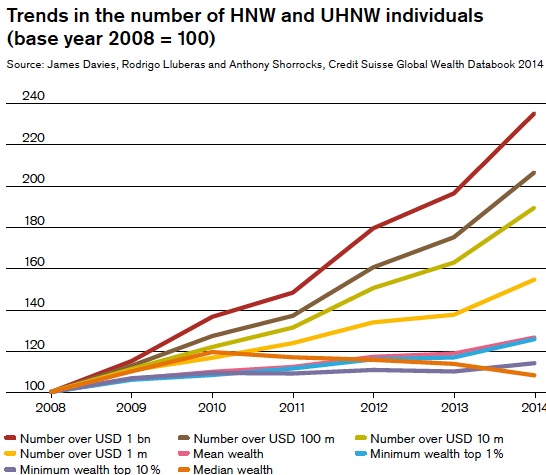

“Between 2008 and mid-2014, mean wealth per adult grew by 26%; but the same period saw a 54% rise in the number of millionaires, a 106% increase in the number with wealth above USD 100 million, and more than double the number of billionaires.”

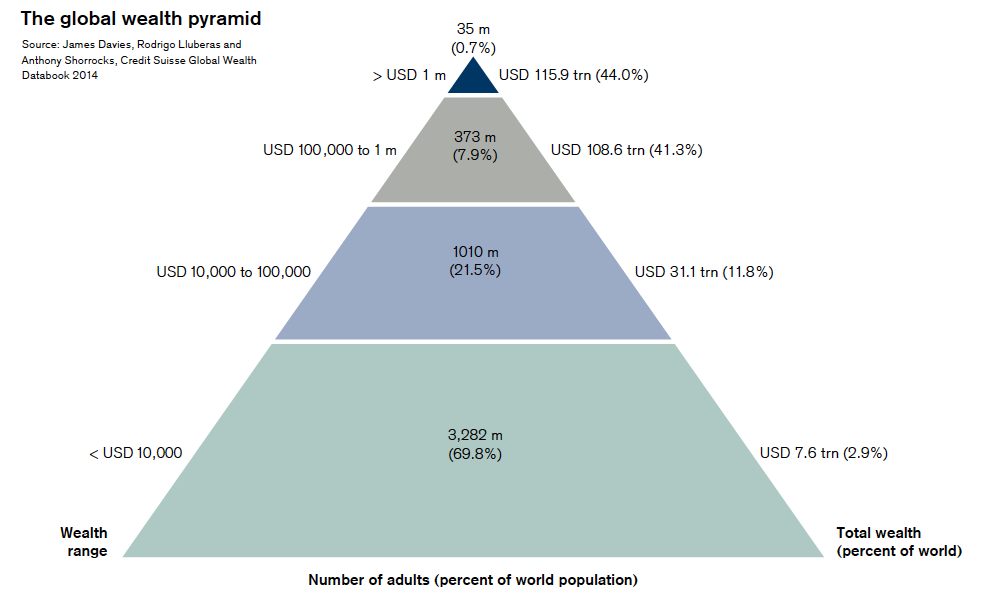

Most striking, perhaps, is the global wealth pyramid.

The rest is here. If 70 percent of the world’s population owns just 2.9 percent of its wealth, one might ask how successful trickle-down theory has been.

The report’s got a few interesting TJN-style observations, such as this one:

“High levels of taxation on large estates appear to be one of the reasons why wealth inequality declined during the 20th century, as wealthier individuals transferred ownership of core assets during their lifetime. Nowadays, family trusts and similar arrangements are frequently used to mitigate estate tax liability, so the impact is now much weaker.”

Not rocket science, but worth remembering.

We have given Credit Suisse a fair share of deserved criticism in the past, but this publication is a valuable public good, and a strike in their favour.

Related articles

Ireland (again) in crosshairs of UN rights body

New Tax Justice Network podcast website launched!

People power: the Tax Justice Network January 2024 podcast, the Taxcast

As a former schoolteacher, our students need us to fight for tax justice

Submission to the UN Special Rapporteur on extreme poverty and human rights’ call for input: “Eradicating poverty in a post-growth context: preparing for the next Development Goals”

17 January 2024

Submission to the Committee on Economic, Social Cultural Rights on the Fourth periodic report of the Republic of Ireland

The Corruption Diaries: our new weekly podcast

Tax Justice Network Arabic podcast #73: ملخص 2023

ESCOLA DE HERÓIS TRIBUTÁRIOS #56: the Tax Justice Network Portuguese podcast