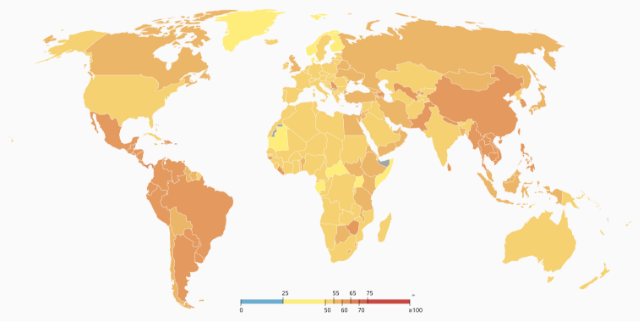

The Financial Secrecy Index ranks countries based on how much financial secrecy they supply to the world. A higher rank on the index does not necessarily mean a country is more secretive, but that the country plays a bigger role in enabling wealthy individuals and criminals to hide and launder money extracted from around the world.

The index is published once every two years.

Go to index1. United States

2. Switzerland

3. Singapore

4. Hong Kong

5. Luxembourg

6. Japan

7. Germany

8. United Arab Emirates

9. British Virgin Islands (British Overseas Territory)

10. Guernsey (British Crown Dependency)

The Corporate Tax Haven Index is a ranking of jurisdictions most complicit in helping multinational corporations underpay corporate income tax. A higher ranking does not necessarily mean a jurisdiction has more aggressive tax laws, but rather that the jurisdiction’s laws and its position in the global economy combine to create a greater risk of corporate tax abuse by multinational corporations.

The index is published once every two years.

Go to index1. British Virgin Islands (British Overseas Territory)

2. Cayman Islands (British Overseas Territory)

3. Bermuda (British Overseas Territory)

4. Netherlands

5. Switzerland

6. Luxembourg

7. Hong Kong

8. Jersey (British Crown Dependency)

9. Singapore

10. United Arab Emirates

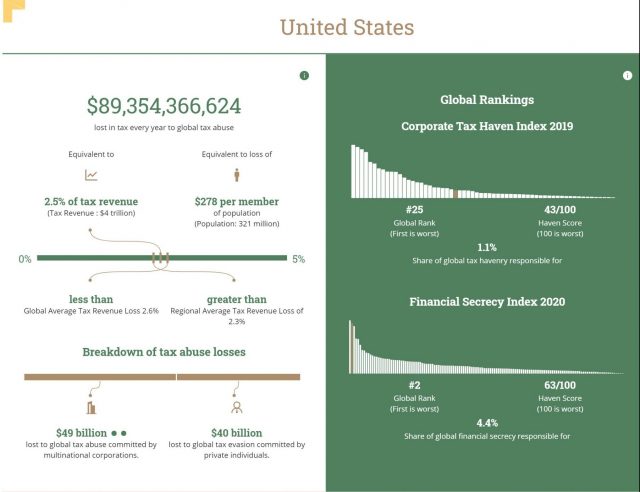

The State of Tax Justice reports how much each country in the world loses in tax each year to cross-border corporate tax abuse by multinational corporations and private tax evasion by private individuals. The State of Tax Justice also provides a snapshot for the year of each country’s ranking on the Tax Justice Network’s indexes and of the country’s vulnerability to illicit financial flows as tracked by the Tax Justice Network’s vulnerability tracker.

The report is published every year.

Go to report

Our one-stop-shop for data on countries’ regulations on tax and financial transparency. The Data Portal features original data produced by the Tax Justice Network and essential data curated from international bodies and academia.

Go to portal

The roadmap sets out 10 targets governments can pursue to create an effective beneficial ownership framework that meaningfully delivers transparency. The roadmap builds on more than 10 years of policy and research experience from the Tax Justice Network on beneficial ownership and draws from more than 140 country-specific assessments conducted by the Tax Justice Network.

Go to roadmap

The Tax Justice Network’s Illicit Financial Flows Vulnerability Tracker measures and visualises each country’s vulnerability to various forms of illicit financial flows over different periods of time.

Go to tracker