Naomi Fowler ■ Let’s shrink the City of London finance sector, for prosperity’s sake

This week journalist and Tax Justice Network writer Nicholas Shaxson sounded the alarm in Britain’s Guardian newspaper about plans for a “Singapore-on-the-Thames” economic model, a tax haven strategy, after Brexit:

The strategy to win the great global race to attract financial capital by lowering taxes, loosening regulations and turning a blind eye to the world’s dirty money.”

As he points out, and as our Financial Secrecy Index and Corporate Tax Haven Index demonstrate, the UK, with its network of satellite jurisdictions is already arguably THE top global offender in the tax haven game. Awareness of the damage that’s doing to the tax base of poorer countries and the harm that’s doing to real people has been rising for years now.

But what’s much less understood is that this model of attracting the world’s dirty money is hurting ‘us’ in Britain too. As Shaxson wrote here recently for the IMF,

The billions attracted by tax havens do harm to sending and receiving nations alike. . . for many economies hosting an offshore financial centre is a lose-lose proposition: it not only transmits harm outward to other countries, but inward, to the host.”

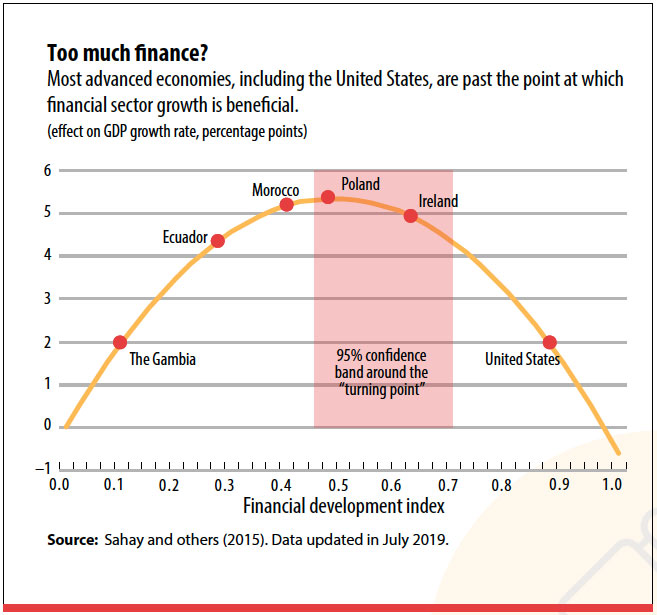

This is the core of the finance curse thesis, which is backed by a large and growing swathe of academic research, as this IMF graph illustrates:

The Guardian article continues:

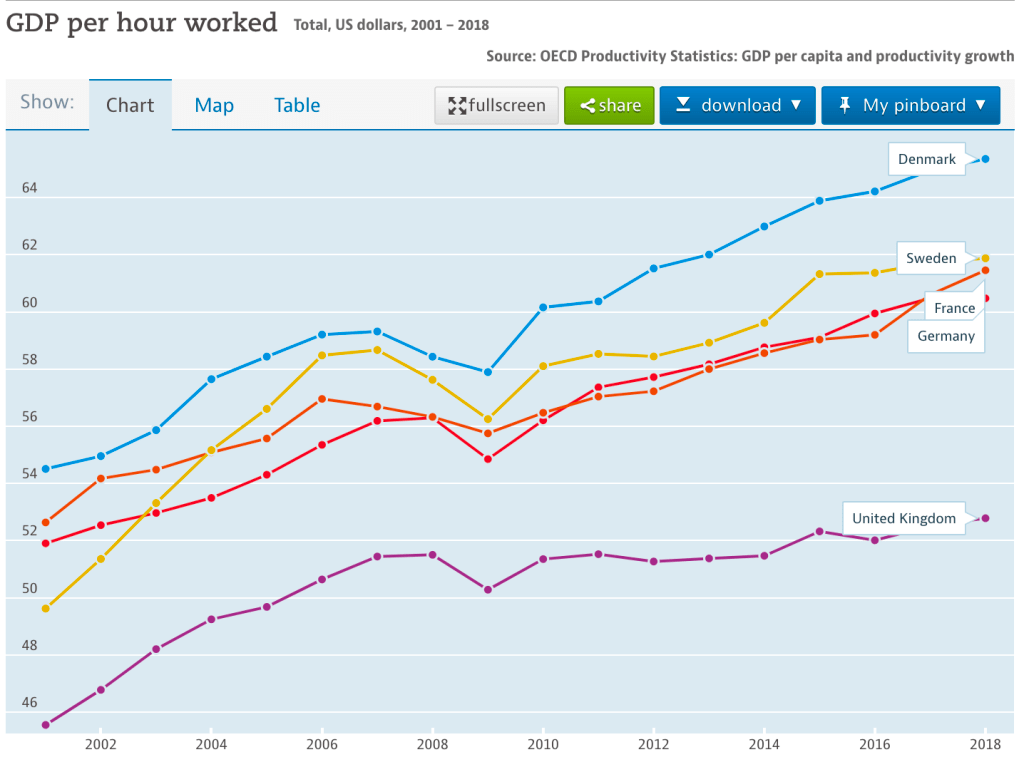

Every nation needs banking and finance, but only up to the point where it provides all the useful services the country needs: taking deposits, lending, handling business payments and so on. But once finance expands beyond this ideal size…the City of London passed this point long ago – it turns nasty. It reduces economic growth, boosts inequality, distorts the economy and curbs entrepreneurialism and productivity (the UK’s is about 10% below France’s or Germany’s, according to the Organisation for Economic Co-operation and Development)“

And here’s the latest graph from the OECD, to illustrate (in fact, these data show the UK’s productivity about 13 per cent below France’s or Germany’s, and about 20 per cent below Denmark’s.)

Indeed, a Sheffield University study last year reckoned the UK lost a cumulative £4.5 trillion in income between 1995 and 2015 due to the City’s bloated size. You can read more on that here. It’s not just Britain, of course: this report Overcharged: The High Cost of High Finance looks at the United States where estimates of supersized finance are also pretty sobering.

The full Guardian article summarises the core point: shrink oversized finance, for the sake of prosperity.

We interviewed Nicholas Shaxson on his recent book “The Finance Curse: How Global Finance Is Making Us All Poorer” on our monthly podcast the Taxcast which is well worth a listen. The interview starts about 12 minutes in, which we’ve cued up here:

Related articles

The secrecy enablers strike back: weaponising privacy against transparency

Privacy-Washing & Beneficial Ownership Transparency

26 March 2024

Inequality Inc.: How the war on tax fuels inequality and what we can do about it

New Tax Justice Network podcast website launched!

El secreto fiscal…tiene cara de mujer: January 2024 Spanish language tax justice podcast, Justicia ImPositiva

Tax Justice Network Arabic podcast #73: ملخص 2023

Get rich cheating in our (educational) tax dodgers version of monopoly

New report on how to fix beneficial ownership frameworks, so they actually work

The Tax Justice Network’s most read pieces in 2023