Naomi Fowler ■ Podcast: Decolonisation and the Expansion of Tax Havens, 1950s-1960s

We’re sharing a fascinating lecture at the University of London’s Institute of Historical Research The lecture has the intriguing title ‘Funk Money’: Decolonisation and the Expansion of Tax Havens, 1950s-1960s and was delivered by Associate Professor Vanessa Ogle of the University of California, Berkeley. The Taxcast was there to record it and you can listen below.

Her forthcoming book is titled ‘Archipelago Capitalism: A History of the Offshore World, 1920s-1980s’ which

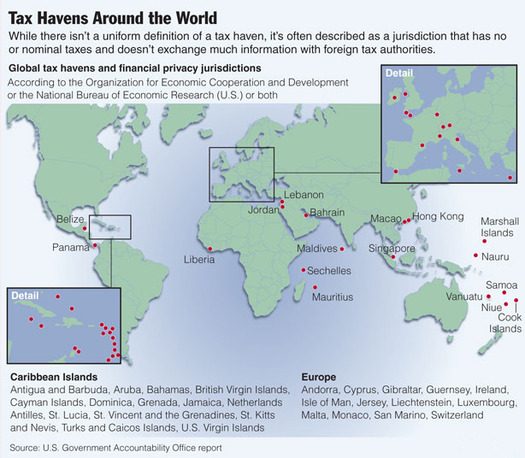

reopens the history of twentieth-century political economy and capitalism (in its free-market, neo-liberal variety in particular) in Europe and beyond, by pointing to an economic, legal, and political regime of smaller, often enclave-like territories and spaces that thrived on the sidelines of a world otherwise increasingly dominated by nation-states: tax havens, offshore finance, flags of convenience, and free trade zones. At the same time, the book provides the first archivally-based account of how ‘offshore’ came into existence as a sophisticated, far-flung system often beyond the reach of national regulators and governments. The book thus seeks to shed light on the origins of tax avoidance and evasion on a global scale, one of the most pressing current problems with profound implications for the rise of inequality throughout the twentieth century. The project uses a multi-archival approach that combines documents from national archives, central banks, multilateral institutions, private banks, and oral history interviews in locations such as Australia, Bahamas, Britain, Canada, Cayman Islands, France, Germany, Guernsey, Ireland, Jersey, Luxembourg, Panama, Singapore, Switzerland, and the US. A pilot article based off this work is forthcoming in The American Historical Review in December 2017.”

The lecture is as interesting as it sounds, have a listen. The power point slides that accompanied the lecture are available here.

Related articles

Policy research conference: How a UN Tax Convention can address inequality in Europe and beyond

Inequality Inc.: How the war on tax fuels inequality and what we can do about it

New Tax Justice Network podcast website launched!

The Corruption Diaries: our new weekly podcast

Overturning a 100 year legacy: the UN tax vote on the Tax Justice Network podcast, the Taxcast

The People vs Microsoft: the Tax Justice Network podcast, the Taxcast

Bahamas: Submission to the UN Independent Expert on the effects of foreign debt and human rights in support of the country visit to the Bahamas

7 November 2023

Submission to the UN Independent Expert on the effects of foreign debt and human rights’ call for inputs: “Fiscal legitimacy through human rights”

7 November 2023

Como impostos podem promover reparação: the Tax Justice Network Portuguese podcast #54

Shaxson’s Treasure Islands is the first…