Nick Shaxson ■ 2012 – The Occupy edition

Tax Justice Focus, Volume 7, Number 1 – The OCCUPY edition.

23 April 2012

The Occupy edition – click here.

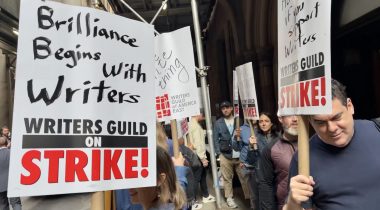

The latest edition of Tax Justice Focus explores how the Occupy Movement has changed public attitudes, not least to tax justice. In the Autumn of 2010 demonstrators from UKUncut started to protest against deals being struck between prominent multinational companies and the British government. Their campaign inspired US Uncut. The latter merged with other groups to create Occupy Wall Street, and suddenly the international political and media establishments began to take notice of tax justice in a way that would have been inconceivable eighteen months ago.

To reflect this seismic shift in the profile of tax justice we asked the Economics Working Group at Occupy at Saint Pauls in London to act as guest editor for this edition. Workingwith our new editor, Dan Hind, they have jointly commissioned the four feature articles published here.

In the lead article, Zoë Young and Jamie Kelsey offer insights into the techniques used in the many Occupy assemblies and working groups around the world.

Next, Carsten Jung explores how shadow bankers use tax havens to avoid regulation and raises the alarm that, four years after the financial crisis, shadow banking is now back to its pre-crisis peak at $60 trillion.

David Dewhurst subsequently explains why, after a career of committee meetings, staff meetings, academic boards and governing body events, he has found the diversity and democracy of the Occupy discussion process intellectually liberating and enjoyable.

And in the final feature article, Philip Goff examines the links between the Arab Spring and the Occupy movement and concludes that the new class struggle is between democratic communities and unrestrained global capitalism.

We also have book reviews on Wilson Prichard’s Taxation and State Building: Towards a Governance Focused Tax Reform Agenda, and John Creedy and Norman Gemmell’s Modelling Corporation Tax Revenue.

This edition also includes a news section and, on the final page, an advertisement for the International Tax Review’s Tax and Transparency Forum 2012, which takes place in London on 2nd May and is FREE to representatives from civil society.

The Occupy edition is available for download here.

Editor: Dan Hind

Guest editor: The Economics Working Group, the Occupy Movement at Saint Pauls

Related articles

The Tax Justice Network’s most read pieces in 2023

Our response to the FATF’s consultation on Guidance on Recommendation 25 on beneficial ownership transparency for legal arrangements

#55 Tous pour une Convention Fiscale Internationale des Nations Unies

Finance climat en Afrique: Une urgence pour les administrations fiscales #54

Strengthening the fight against money laundering: Criminalisation of the EU directive

Can the UN succeed? Top questions about our State of Tax Justice report

Why the world needs UN leadership on global tax policy

The unexploited silver bullet to tackle enablers: mandatory disclosure rules

Split among EU countries over beneficial ownership ruling mirrors rankings on Financial Secrecy Index